> At a Glance

> – Whale-sized XRP transfers leapt to 2,802 on Tuesday, the most since October

> – Binance reserves slid to 2.6 billion tokens, their lowest since January 2024

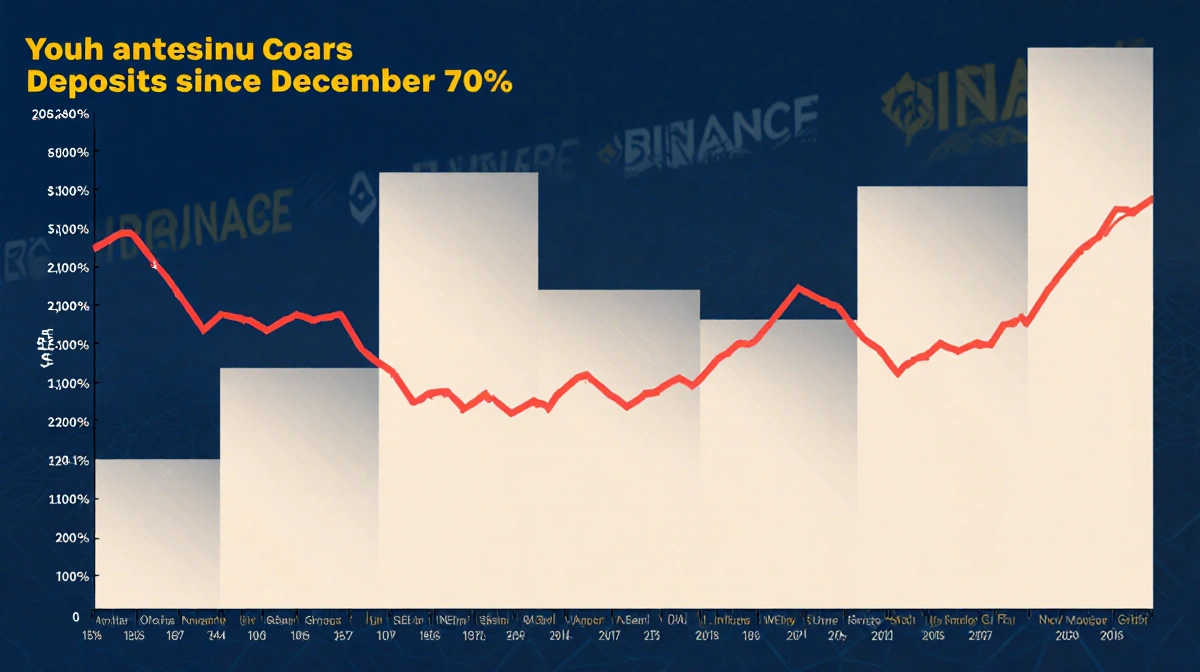

> – Whale deposits to the exchange have fallen from 70% to 60% since mid-December

> – Why it matters: Large holders appear to be repositioning rather than selling, signaling potential volatility ahead

XRP is flashing contradictory signals: whales are moving record amounts while exchange balances drain and prices retreat. The divergence suggests major holders are shifting coins into private wallets rather than preparing to liquidate.

Whale Surge Meets Exchange Drain

Santiment tracked 2,170 transfers worth $100,000-plus on Monday, then watched the tally spike to 2,802 the next day-the busiest whale traffic in three months. The analytics firm warns that markets usually turn choppier when big players become this active.

The twist? Coins are leaving exchanges at the same time. CryptoQuant data show Binance’s XRP stash has fallen from 3.25 billion to 2.6 billion tokens since late 2025, a classic sign of holders moving supply into self-custody.

- Whale transfers up 29% in 24 hours

- Exchange balance down 20% in seven weeks

- Retail deposit share holding steady

Whale Inflows Lose Momentum

Arab Chain analysts note that whale deposits to Binance have cooled since December. After commanding over 70% of total inflows in November, large deposits now account for about 60%, while retail activity remains flat. Historically, fewer whale inflows mean less immediate selling pressure from the biggest wallets.

| Metric | Late 2025 | Current |

|---|---|---|

| Whale inflow share | 70%+ | ~60% |

| Binance XRP reserves | 3.25B | 2.6B |

| Daily whale transfers | 2,170 | 2,802 |

Price Pullback Keeps Bulls Alert

XRP changed hands near $2.13 on Wednesday, down 6% in 24 hours after tagging $2.40 earlier in the week. Despite the dip, the token remains 16% higher over seven days and 14% up across two weeks. Chart watchers flag $2.27 as key support; holding it could preserve the broader uptrend.

CNBC’s Power Lunch labeled XRP the “hottest crypto trade of 2026” on January 6, citing investor appetite for outsized moves relative to Bitcoin or Ethereum.

Key Takeaways

- Whale transfer count hit a quarterly high even as prices slid

- Falling exchange balances suggest accumulation, not distribution

- Whale deposit share has declined 10 percentage points since November

- Technical support at $2.27 remains the level to watch

With whales shuffling coins off exchanges at the fastest clip in months, the stage is set for sharper moves should buyer interest return.