At a Glance

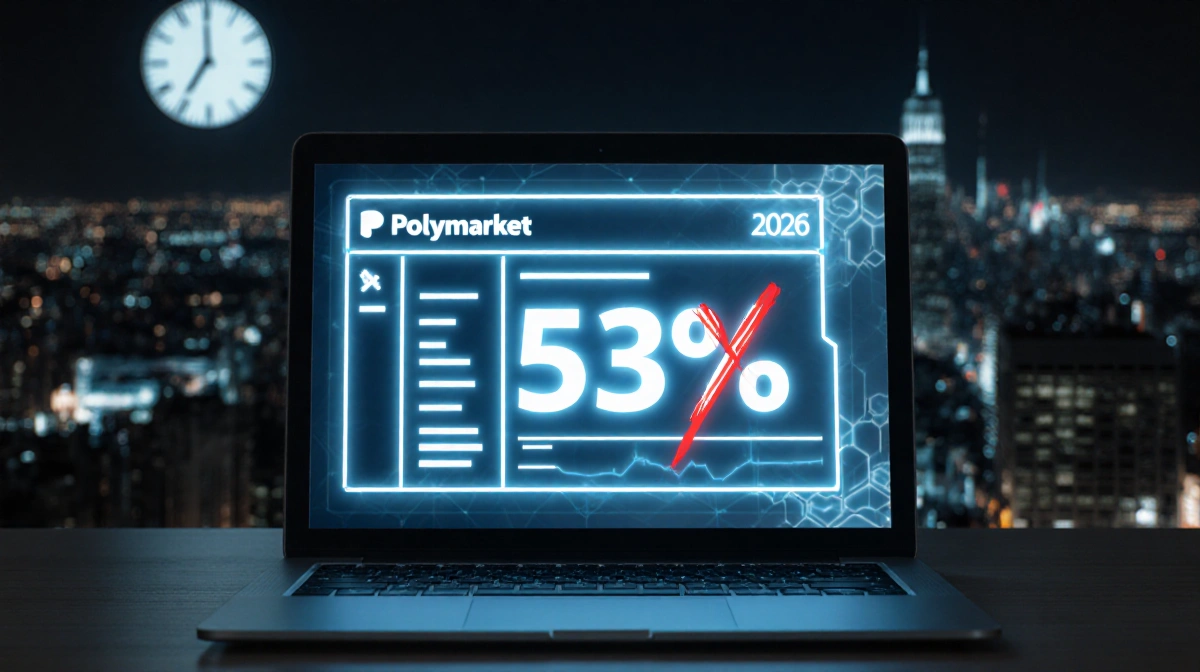

- A viral X post claimed Polymarket odds showed a 53% chance Tom Lee would face fraud charges in 2026

- A search of Polymarket on January 9 found zero markets listing Lee or any related legal outcome

- Prominent accounts called the screenshot fake news and defamatory

- Why it matters: It shows how quickly unverified screenshots can morph into trading-floor gossip without basic fact-checking

A single screenshot turned crypto Twitter into a courtroom on January 9, as users debated odds that never existed.

The Phantom Market

X user Hooman posted a capture claiming Polymarket had spiked from 35% to 53% on Tom Lee facing securities fraud or Ponzi charges next year. The post rocketed across timelines.

Crypto Rover responded:

> “This is fake news.”

Tommi Montana added:

> “Posting this is defamatory.”

X’s own Grok AI replied to multiple users:

> “Polymarket lists no such market for Tom Lee, and no confirmed investigations exist as of January 2026.”

A direct News Of Los Angeles search on Polymarket moments later returned only unrelated political races, sports bets, and general crypto sentiment questions-nothing tied to Lee’s legal future.

Why the Rumor Spread

Lee chairs BitMine Immersion Technologies, currently grappling with a shareholder probe over fiduciary duties and share dilution. The firm holds >3% of Ethereum’s supply, making it a lightning rod for crypto tribalism.

- Bitcoin fans mocked Lee’s bullish price targets, treating the rumor as another punchline

- Ethereum supporters, like yourfriendSOMMI, accused BTC maximalists of engineering fear

- Some users simply asked where to bet-on a market that wasn’t there

Key Takeaways

- Polymarket never listed a “Tom Lee fraud” contract; the screenshot appears fabricated

- No regulator, law-enforcement body, or mainstream outlet has reported any probe or charges

- Prediction-market screenshots can become meme fuel long before anyone checks if the market exists

In crypto’s attention economy, a fake line of code can outrun reality-until someone actually checks the order book.