At a Glance

- Iran’s cryptocurrency activity reached $7.78 billion in 2025, outpacing 2024 growth

- IRGC-linked addresses captured over 50% of total value in Q4 2025

- Major spikes followed Kerman bombings, missile strikes, and June 2025 conflict

- Why it matters: Sanctions, 90% currency collapse, and 40-50% inflation drive Iranians toward crypto as financial lifeline

Iran’s cryptocurrency ecosystem swelled to more than $7.78 billion in 2025, accelerating past the previous year’s pace as political turmoil and economic collapse pushed both citizens and the IRGC deeper into digital assets.

Wars, Protests, and a Plunging Currency

Chainalysis traced Iran’s surging crypto volumes to specific flashpoints. The January 2024 Kerman bombings that killed nearly 100 people at a Qasem Soleimani memorial triggered an immediate on-chain surge. October 2024 saw another leap after Iran launched missile strikes against Israel following the assassinations of Hamas leader Isma’il Haniyeh in Tehran and Hezbollah leader Hasan Nasrallah in Beirut.

The most concentrated spike arrived in June 2025. During a 12-day shadow-war escalation, joint US-Israeli strikes hit Iran’s nuclear and ballistic-missile facilities. Cyberattacks crippled Nobitex, Iran’s largest exchange, and Bank Sepah, the IRGC’s preferred bank. Iranian state television feeds were also hacked. Transaction volumes jumped as the rial plunged.

IRGC’s Crypto Footprint

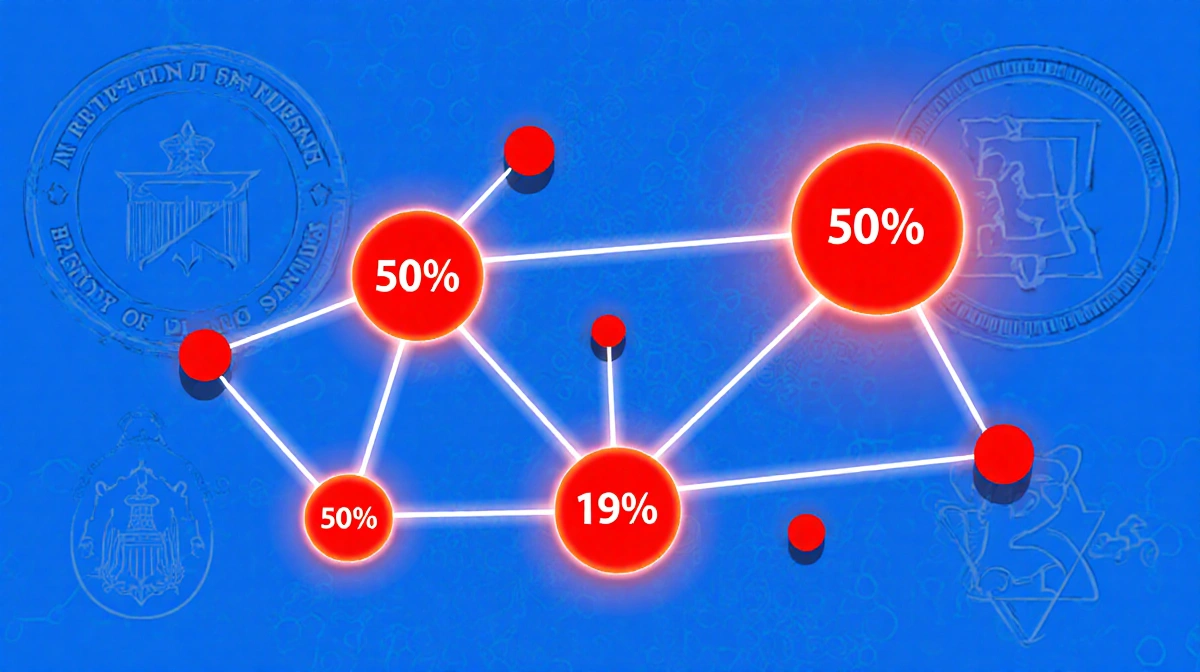

IRGC-linked facilitation networks dominated the Iranian crypto economy by late 2025. Addresses flagged through US Treasury and Israeli sanctions captured more than 50% of total value received in Q4. The flow topped $2 billion in 2024 and surpassed $3 billion in 2025.

Chainalysis cautioned these figures are a lower-bound estimate. Shell companies, undisclosed facilitators, and unidentified wallets tied to IRGC operations-spanning illicit oil sales, sanctions evasion, money laundering, and proxy funding-suggest an even larger footprint.

Citizens Flee to Self-Custody

Ordinary Iranians shifted behavior during the mass protests of late December 2025 and early January 2026. An internet blackout could not stop a surge in:

- Average daily transaction values

- Transfers to personal wallets

- Withdrawals from Iranian exchanges to personal Bitcoin wallets

The trend signals Bitcoin’s role as self-custody and capital preservation while the rial shed roughly 90% of its value since 2018 and inflation hovers between 40-50%.

Key Takeaways

- Iran’s crypto economy is now a $7.78 billion market growing faster than in 2024

- Geopolitical shocks, not speculation, drive the biggest volume spikes

- The IRGC commands the majority of inflows, underscoring crypto’s dual use for sanctions evasion

- Citizens increasingly treat Bitcoin as a hedge against currency collapse and political risk