Ethereum is trading in a constructive but still corrective phase, with the price holding above the main higher-timeframe demand zones while encountering persistent supply under the declining daily moving averages.

The broader structure suggests that the aggressive selloff from the highs has transitioned into a basing and mean-reversion phase rather than a completed bullish reversal, while on-chain activity points to gradually improving participation rather than euphoric risk-taking.

At a Glance

- ETH is capped below $3,400 resistance despite rising network usage

- Daily moving averages remain in decline, signaling a corrective regime

- On-chain transaction count has climbed back above 2 million

- Why it matters: Price has not yet reflected the rebound in network demand, hinting at a potential mismatch that could fuel the next directional move

Daily Chart: $2,700 Support vs. Moving-Average Resistance

On the daily timeframe, ETH continues to oscillate around the declining 100-day moving average while also remaining below the 200-day moving average, placing the asset in a corrective regime.

Yet, the asset has repeatedly respected the $2,700 region as the primary demand zone, with a deeper structural floor around the $2,100-$2,300 range. The market is now pressing into the $3,500 resistance band that previously acted as a distribution zone.

As long as the $2,700 support area holds on a closing basis, the medium-term structure can be interpreted as a large consolidation within a longer-term bullish trend. The absence of a decisive reclaim of the daily 100-day and 200-day moving averages and the overhead supply zone reinforces the view that this is still a recovery leg inside a wider range rather than the start of an impulsive trend expansion.

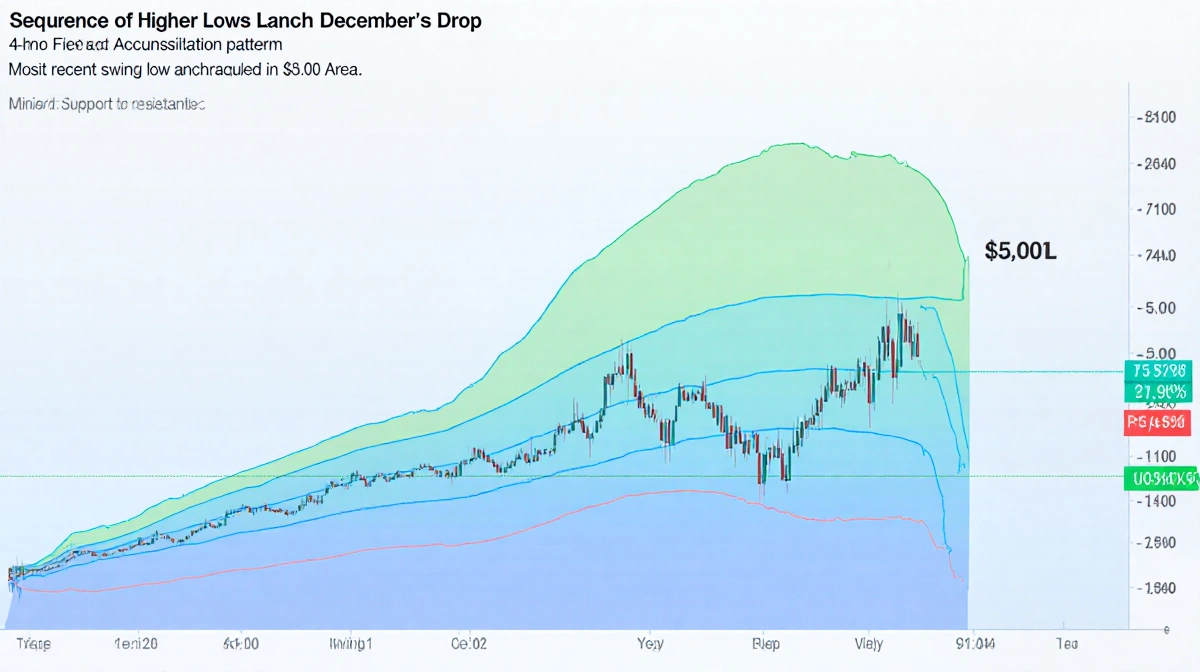

4-Hour View: Higher Lows Form Rounded Accumulation

The 4-hour chart shows a clear sequence of higher lows since the December drop, forming a rounded accumulation pattern with the most recent swing low anchored in the $3,000 area.

Key observations:

- Price has rotated between $3,000 support and the $3,300-$3,400 resistance zone

- Sellers capped the latest advance at the range top and triggered a pullback in the past 24 hours

- A curved higher-low structure remains intact as long as ETH stays above $3,000

A sustained break below $3,000 would signal that the corrective leg is extending and reopen the path toward the critical $2,800 support zone.

On-Chain Metrics: Network Usage Rises While Price Lags

On-chain, the total Ethereum transaction count and its 30-day exponential moving average are trending higher and are now showing values above 2 million, even though the price remains below the previous cycle peak.

This divergence between rising transactional activity and a still-recovering price profile is consistent with a backdrop of rebuilding fundamental demand: network usage is increasing while price has not yet fully reflected that improvement, a configuration often associated with early or mid-stage phases of a new growth leg.

Elevated transaction counts near resistance can coincide with periods of heightened rotation and short-term profit-taking. Confirmation in the form of a sustained reclaim above the $3,400 resistance band would be required before this on-chain strength can be treated as validation of a fully re-established bullish trend.

Key Takeaways

- ETH remains in a corrective regime below the daily 100- and 200-day moving averages

- Repeated defense of the $2,700 demand zone keeps the medium-term outlook neutral-to-bullish

- Short-term structure favors another test of $3,300-$3,400 supply as long as $3,000 higher low holds

- Rising on-chain activity above 2 million transactions per day signals improving network fundamentals that have yet to be priced in

- A decisive close above $3,400 is needed to confirm a shift from range-bound repair to trend expansion