Cardano whales have bought 210 million ADA in three weeks as the price falls to $0.36, signaling a possible shift despite bearish sentiment.

At a Glance

- Large wallets accumulated 210 million ADA during a three-week price slide

- Token trades at $0.36, down 7% in 24 hours and below the 9-week EMA of $0.41

- Exchange reserves edge lower, tightening near-term supply

- Why it matters: Whale stocking while retail hesitates often precedes volatile moves

Over the last three weeks, large Cardano (ADA) holders have accumulated more than 210 million tokens, according to blockchain data shared by analyst Ali Martinez. This activity has emerged during a period of price weakness, with ADA falling by over 7% in the last 24 hours and trading near $0.36.

The token has traded between $0.36 and $0.40 in the past 24 hours, with a broader 7-day range of $0.36 to $0.43. Market pressure has increased amid renewed tensions between the European Union and the United States, adding to the pullback across digital assets.

Whale Accumulation Meets Price Weakness

The accumulation of 210 million ADA by large wallets took place while prices remained under pressure. On-chain activity suggests this move reflects preparation rather than response.

210 million Cardano $ADA bought by whales in the past three weeks! pic.twitter.com/Mqq4xdQGSK

- Ali Charts (@alicharts) January 17, 2026

While ADA’s price has not yet responded to this buying, exchange reserves have slightly decreased. This suggests a less available supply for immediate trading. In this type of setup, smaller demand spikes can have a stronger effect on the price.

Even so, whale accumulation does not guarantee an immediate reversal. It sets a base that may support future moves, if confirmed by volume and momentum.

Technical Setup Shows Tight Range

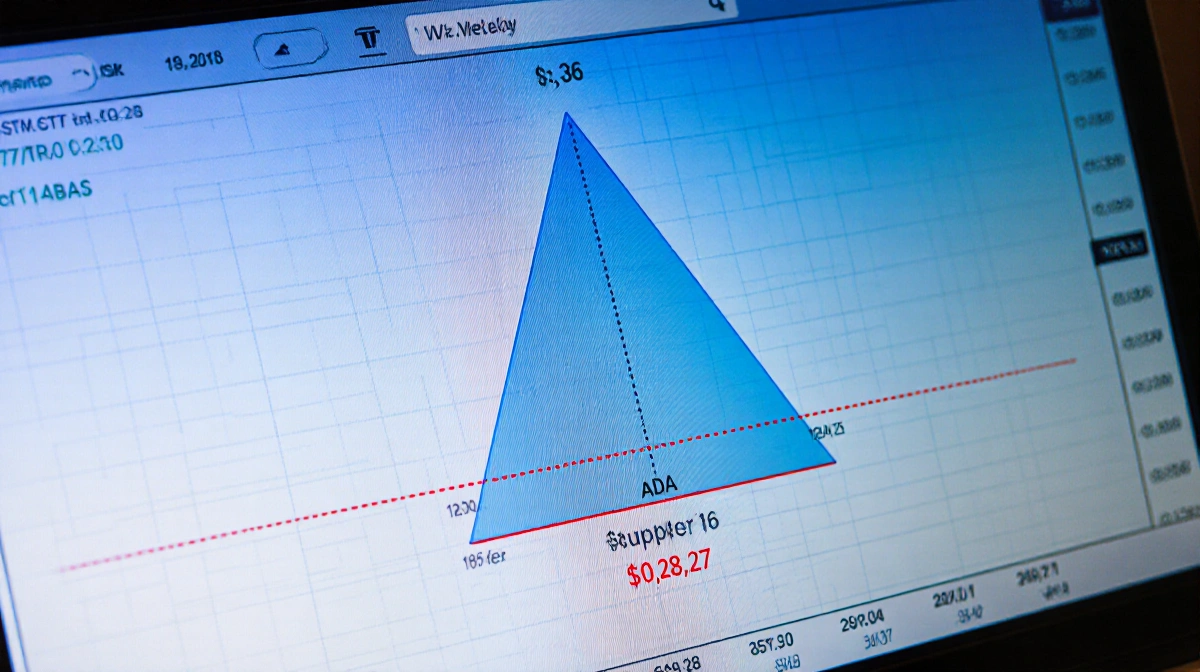

Currently, ADA is moving along the bottom edge of a symmetrical triangle that has been forming on the weekly chart. It is trading just above the $0.36 mark, which is part of a long-tested support zone ranging down to $0.28. A break below this level could push the token toward $0.27.

The 9-week EMA is positioned at $0.41. ADA continues to trade below it, showing sellers remain in control. For sentiment to shift, it would need to reclaim this level and attempt to move toward $0.53. On the momentum side, the weekly RSI reads at around 33, hovering near levels often seen before short-term recoveries.

Futures Traders Bet on More Downside

Recent data from Coinglass shows the open interest-weighted funding rate for ADA at -0.0037%. The rate has moved frequently between positive and negative in recent weeks, reflecting uncertain sentiment among futures traders. The current trend reflects cautious expectations from derivatives traders.

Negative funding rates like this typically occur when the majority of traders expect continued downward movement. Combined with price staying below resistance and support being tested, this adds pressure to the short-term outlook.

Institutional Developments Add Long-Term Angle

Elsewhere, the Cardano Foundation shared support for a proposal by Draper Dragon and Draper University. The plan involves a $80 million fund focused on expanding Cardano’s adoption through investments, capital deployment, and education. Returns from the fund would be routed back to the Cardano treasury.

In addition, CME Group is preparing to introduce ADA futures, with trading expected to begin on February 9, pending regulatory clearance. This move would place ADA in line with other top altcoins available in the U.S. derivatives market.

Key Takeaways

- Whale wallets added 210 million ADA during a three-week downturn

- Spot price hovers at $0.36, under the $0.41 9-week EMA

- Exchange supply shrinks slightly, possibly amplifying later demand

- Futures traders display negative funding, hinting at bearish bias

- Macro tensions and EU-U.S. friction weigh on broader crypto sentiment

- Institutional tailwinds include an $80 million adoption fund and looming CME futures

The clash between aggressive whale accumulation and fragile retail sentiment leaves ADA at a technical crossroads. A sustained hold above $0.36 could validate the whale thesis, while any slip toward $0.28 may invite deeper selling before the next bounce.