Ethereum (ETH) is currently forming an inverse head-and-shoulders chart pattern that analysts say could herald a breakout near the $4,000-$4,400 resistance zone. The move follows a sharp 65% decline in early 2022 and a recent 5% slide after a brief dip to $3,300.

At a Glance

- Inverse head-and-shoulders pattern emerging 2024-2026

- Neckline sits between $4,000 and $4,400

- Current price around $3,100 with recent 5% loss

- Institutional activity: Bitmine invested $14.6 B in 2025, staking at all-time highs

- Why it matters: A breakout could lift ETH into a new price echelon, altering market dynamics

Historical Context: 2021-2022 Head-and-Shoulders

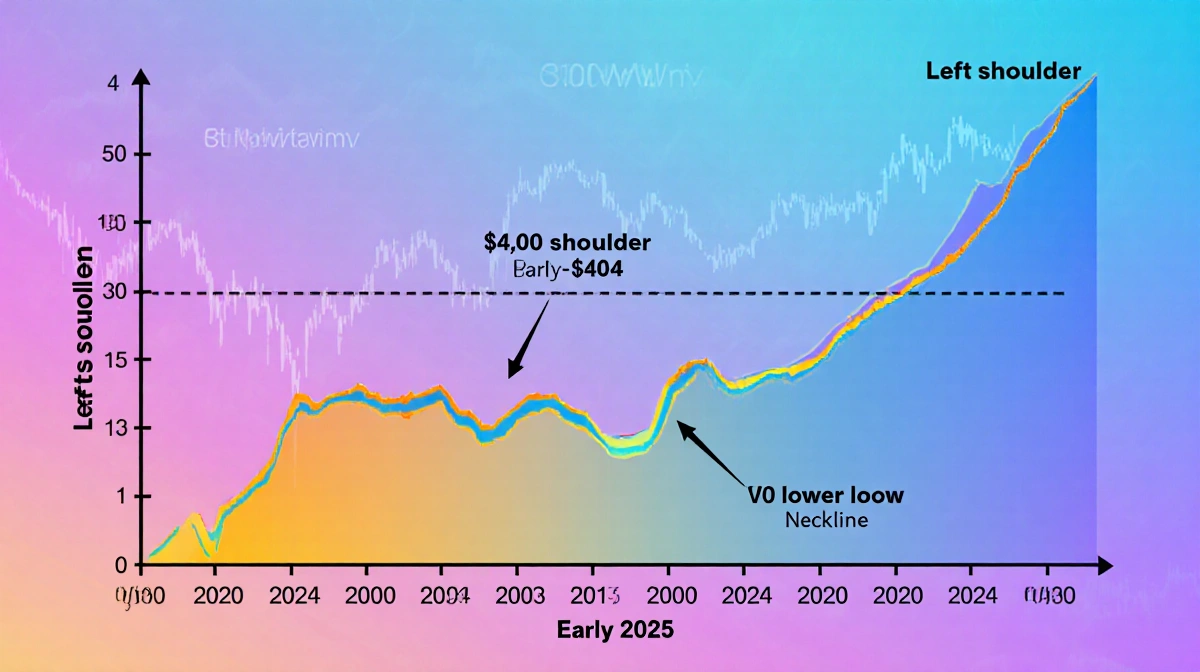

In mid-2021, Ethereum formed a classic head-and-shoulders pattern. The left shoulder peaked in the middle of 2021, the head rose later that year, and the right shoulder appeared in early 2022. The neckline support failed in mid-2022, triggering a drop of over 65% in less than two months.

The New Inverse Pattern (2024-2026)

The current setup mirrors the earlier reversal but in reverse order:

- Mid-2024: left shoulder

- Late 2024: lower low forming the head

- Early 2025: right shoulder forming

The neckline, the critical support level, now lies between $4,000 and $4,400, a distance from the present trading floor.

Recent Price Action & Market Sentiment

At press time, ETH traded at $3,100. In the last 24 hours it fell more than 3%, and over the past week it slid 1%. On Sunday, the price briefly crossed $3,300 before retreating. Since the weekend, the asset has lost around 5%.

| Time Frame | Movement |

|---|---|

| 24h | -3% |

| 7d | -1% |

| Since weekend | -5% |

The decline coincides with broader market stress linked to renewed global trade concerns.

Staking Surge & Institutional Interest

Staking activity has reached an all-time high, with new inflows continuing to add value to locked-up ETH. Analysts note that the CME gap near $3,000 is expected to fill before the next target of $3,200.

> “First, the CME gap near 3k will be filled, and then the next target will be 3.2k,” said CW, a market analyst.

In 2025, Bitmine invested $14.6 B into ETH. However, the firm has remained quiet in 2026.

> “Bitmine poured $14.6B into ETH last year, but it’s been quiet since the new year began,” reported Maartunn (@JA_Maartun) on January 20, 2026.

Analyst Perspectives

A CryptoQuant analyst, OnChain, highlighted the segmentation of price action and time:

> “I see not only price action segmented into parts, but also time itself.”

The same report tracks institutional holdings and ETF interest, noting responses to regulatory developments such as the Clarity Act.

Key Takeaways

- An inverse head-and-shoulders pattern suggests a potential breakout near $4,000–$4,400.

- The current price of $3,100 is below the neckline, indicating room for upside.

- Staking volumes are at record highs, supporting long-term demand.

- Institutional inflows, notably from Bitmine, signal confidence but have paused in 2026.

- Market stress from global trade concerns has caused a recent 5% slide.

Investors watching Ethereum should monitor the neckline breakout, staking trends, and institutional activity for signals of a new uptrend.