Bitcoin has fallen below $90,000 and now hovers above a critical support level that, if broken, could send the price tumbling toward the $60,000 zone.

At a Glance

- Bitcoin dropped to $87,900 early Tuesday, its lowest point since December

- A bear flag pattern suggests a potential 31% decline to the $60K-$61K range

- Over $1 billion in leveraged crypto positions were liquidated during the slide

- Why it matters: A breakdown below $87,000 could trigger another major sell-off, wiping out recent gains and shaking investor confidence

The cryptocurrency spent the weekend trading near $95,000, but fresh tensions between the United States and the European Union, combined with volatility in Japanese bond markets, pressured risk assets. Bitcoin slid from $95,500 to under $92,000 within hours. A modest rebound followed, yet the recovery faded early Tuesday when the price touched $87,900 before settling around $89,100. Data from CoinGecko shows Bitcoin is down 2% in 24 hours and 6% over the past week.

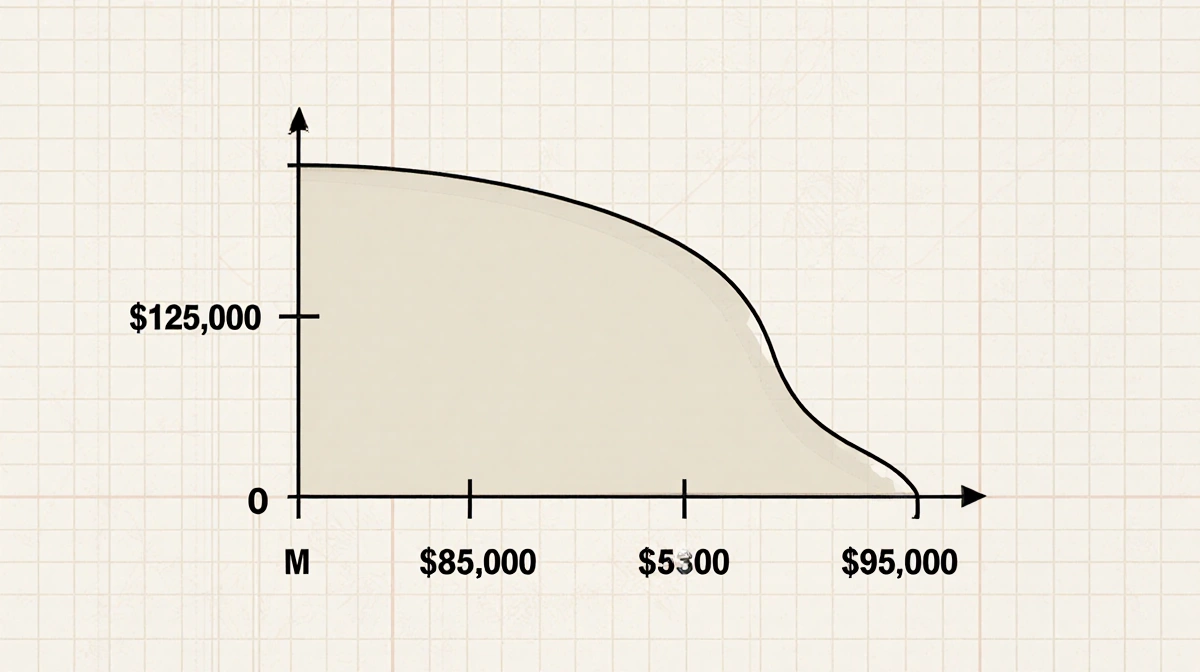

Bear Flag Targets $60K

The daily chart now displays a classic bear flag. The pattern began after Bitcoin crashed 32% from a peak near $126,000 to $85,000. Since that plunge, the asset has traded inside a gently rising channel-typically a brief pause before another leg down.

Crypto analyst Crypto Patel told followers:

> “$BTC is testing critical $87K bear flag channel support. Breakdown and sustained close below this level opens path to $60K liquidity zone.”

Should the $87,000 support fail, the measured move implies a further 31% drop, targeting the $60,000-$61,000 region. Veteran trader Peter Brandt has also flagged the risk of a decline into the $58,000-$62,000 range if the pattern completes.

Michaël van de Poppe, founder of MNF Fund, noted that Bitcoin has already taken out recent lows while the relative strength index hovers near oversold territory. He warned:

> “We could see a short-term bounce, not a reversal.”

For a genuine trend reversal, the price would need to reclaim several resistance layers still towering above the market.

Macro Headwinds Add Pressure

Broader markets are on edge. Bond yields are climbing, gold is surging, and geopolitical anxiety is rising as world leaders gather in Davos for a Thursday meeting. The risk-off mood has spilled into crypto, amplifying selling momentum.

Whales Move as Leverage Wipes Out

The slide below $90,000 triggered liquidations exceeding $1 billion across leveraged crypto positions, per CoinGlass. Yet large wallets have turned active. Amr Taha, analyst at CryptoQuant, observed that more than $400 million worth of BTC flowed into spot exchanges on January 20. A similar spike occurred on January 15, preceding a swift drop to $96,000.

Binance Futures data reinforces the selling pressure. Net Taker Volume recorded a reading of -$319 million on January 20, the second time this month the metric has plunged below -$300 million.

Key Takeaways

- Bitcoin’s bear flag pattern puts $87,000 in focus; a daily close beneath that level could accelerate losses toward $60,000

- Macro uncertainty, rising bond yields, and geopolitical tension continue to weigh on risk assets

- Liquidations topped $1 billion, yet whales are transferring coins to exchanges, signaling potential further selling