Bitcoin’s price has cratered $10,500 from its mid-week high while deep-pocketed investors scoop up coins at a furious pace.

At a Glance

- Bitcoin slid from $98,000 to $87,500 in nine days

- Wallets holding 10-10,000 BTC added 36,322 coins worth $3.2 billion

- Small holders sold 132 BTC, trimming their stacks by 0.28%

- Why it matters: Retail panic meets institutional appetite as geopolitical fears rattle markets

The flagship crypto touched a multi-month peak of $98,000 last week before a wave of selling knocked it below $88,000. By Monday the token had steadied near $89,400, still down more than 10% from its recent top.

Geopolitical Jitters Fuel Selloff

Escalating tensions between the United States and the European Union have rekindled the bearish mood that first surfaced in Q4 2025. Analysts at Saxo Bank point to a “relentless surge in long-dated JGB yields” as another catalyst for risk-off flows across global markets.

While Bitcoin bled, gold raced to a fresh all-time high of almost $4,900/oz and silver neared the psychological $100 mark.

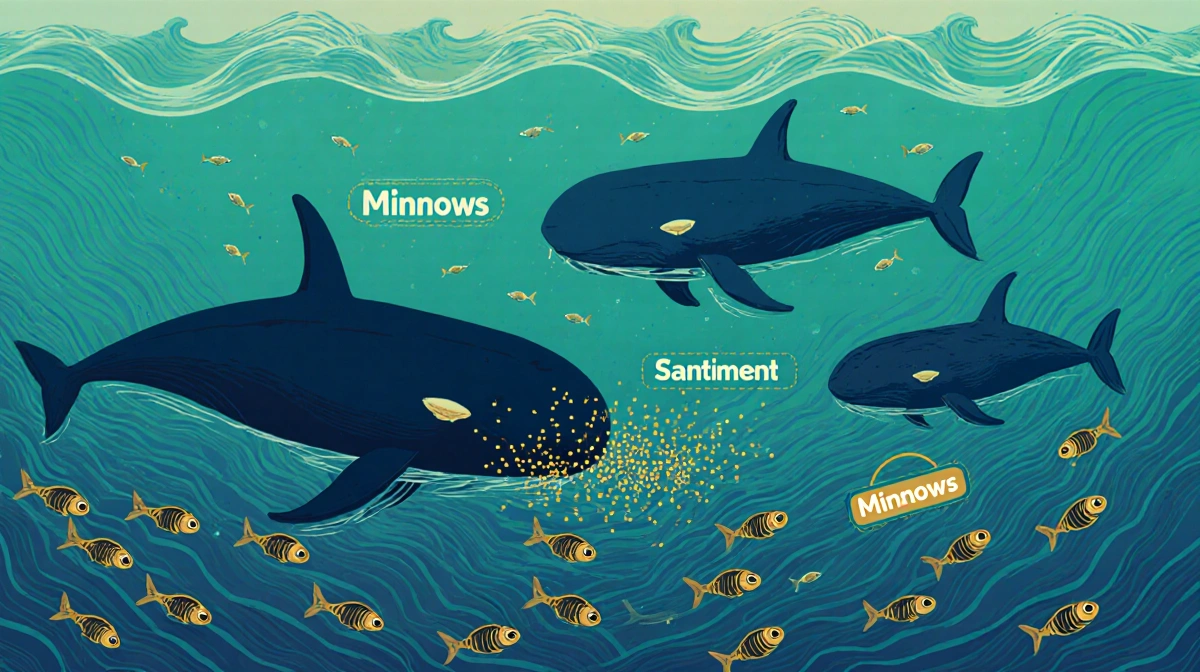

Whales Feast as Minnows Flee

Blockchain data from Santiment show two divergent trends:

- Large wallets (10-10,000 BTC) accumulated 36,322 coins since January 11, boosting their collective balance by 0.27%

- Small wallets (under 0.01 BTC) offloaded 132 coins, a 0.28% reduction in their holdings

At current prices the whale purchases total roughly $3.2 billion.

A sizable chunk of the buying likely came from business-intelligence firm Strategy. The company, led by Michael Saylor, disclosed the purchase of 22,305 BTC during the previous business week, cementing its status as the largest corporate holder of the cryptocurrency.

Market Reaction

The rapid reversal has traders recalibrating expectations. Bitcoin’s fear-and-greed gauge has swung toward caution, while derivatives desks report a pickup in put-option demand.

Still, long-term holders view the dip as another accumulation opportunity. The whale cohort now controls a record percentage of circulating supply, a dynamic that historically precedes supply squeezes when demand returns.

Key Takeaways

- Bitcoin’s $10,500 slide in nine days marks the steepest pullback of 2026

- Institutional wallets absorbed the supply, adding 36,322 BTC worth $3.2 billion

- Small investors trimmed exposure by 132 BTC, underscoring retail jitters

- Macro headwinds-geopolitical friction and rising JGB yields-overshadow crypto-specific fundamentals

- Precious metals continue to outperform, with gold at $4,900/oz and silver eyeing $100