At a Glance

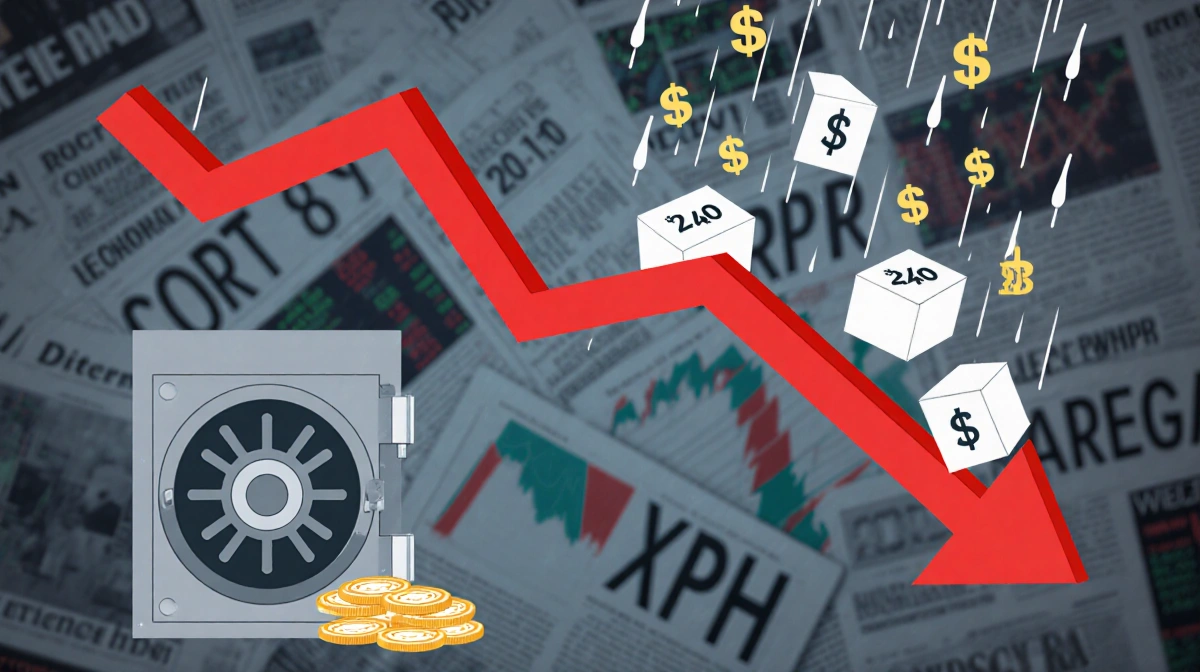

- XRP ETFs posted their worst single-day outflow of $53.32 million on Tuesday

- The funds went from $1.28 billion to $1.22 billion in cumulative net inflows in one session

- XRP fell from a January 6 peak above $2.40 to near $1.86

- Why it matters: The sell-off wipes out an entire week of inflows and pushes the asset below key support

A fresh wave of risk-off sentiment across global markets has hammered crypto harder than any other asset class, with Ripple-focused exchange-traded funds absorbing the heaviest damage on the first U.S. trading day of the week.

ETF Carnage in One Session

Data from SoSoValue show that the five U.S.-listed XRP ETFs lost $53.32 million on Tuesday, their largest single-day outflow since launch. The bleeding reversed a nine-day green streak that had added $60 million between January 8 and January 16.

| Metric | Before Tuesday | After Tuesday |

|---|---|---|

| Cumulative net inflows | $1.28 billion | $1.22 billion |

| Daily outflow | – | $53.32 million |

| Sessions without red ink | 9 | 0 |

Canary Capital’s XRPC-the first fund to offer pure-play exposure when it debuted in early November-had notched a record first-day volume in 2025 and remained in positive territory every session until January 7. A modest $40 million outflow then was quickly reversed, keeping the products’ combined balance sheet in the black until this week’s geopolitical flare-up.

Price Action Turns Ugly

The massive withdrawals coincided with fresh technical weakness. XRP touched a multi-month high of $2.40 on January 6, capping a 30 percent sprint in under a week. Momentum evaporated as headlines about U.S.-EU trade tensions intensified.

- Monday: the token sliced through the psychological $2.00 level

- Overnight: lows reached $1.84 on some venues

- Current bid: hovering just above $1.90, after dipping to $1.86 during the midnight rout

CryptoWZRD flagged the bearish daily close, particularly the XRP/BTC pair, telling followers that “Bitcoin will be in charge” and that lower-time-frame scalps would be the preferred strategy until a clear directional break emerges.

Market Context

Tuesday’s outflow figure eclipsed the prior record and erased virtually all of the previous business week’s haul. The ripple effect leaves the XRP ETF complex nursing a $60 million setback in cumulative flows after what had been a flawless start to the year.

With macro clouds darkening and the dollar surging, investors yanked cash from risk assets across the board. Crypto bore the brunt, and products offering concentrated exposure to smaller-cap tokens felt the hardest hit.

Key Takeaways

- XRP ETFs surrendered $53.32 million in the worst daily outflow on record

- Total cumulative inflows dropped from $1.28 billion to $1.22 billion in a single session

- Nine consecutive days of net inflows came to an abrupt halt

- XRP price slid from $2.40 to near $1.86 in two weeks

- Analysts now watch the $1.90 support and Bitcoin’s dominance for the next cue