At a Glance

- Pi Network’s token price dropped to $0.17, the lowest level since trading began.

- Market capitalization slipped below $1.5 billion, ranking the token 75th-largest in the market.

- Nearly 150 million Pi tokens are expected to unlock in the next month, potentially adding selling pressure.

- Why it matters: The price collapse signals renewed bearish sentiment for Pi Network, while upcoming unlocks may further influence the token’s trajectory.

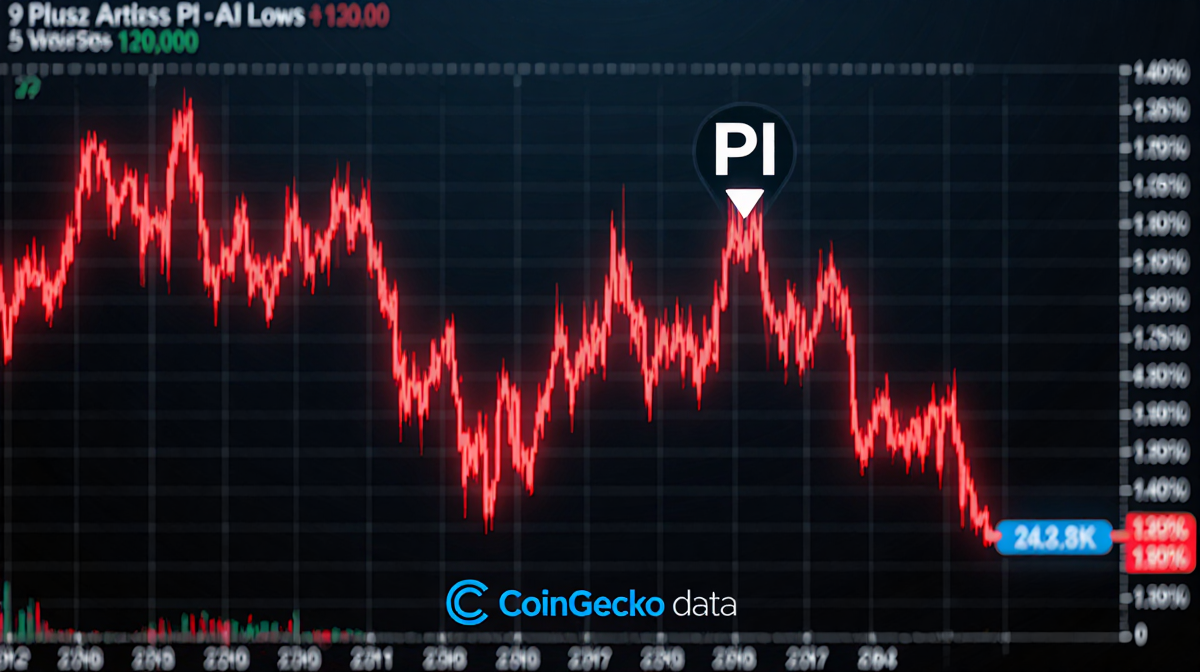

The price of Pi Network’s native token, PI, fell sharply to $0.17 earlier today, marking the lowest level recorded since the token began trading in February of last year. The move dropped the token’s market capitalization below $1.5 billion, placing it as the 75th-largest cryptocurrency by market cap. The decline coincided with broader market weakness, as Bitcoin slipped below $88 000 and Ethereum briefly fell to $2 780.

Price Decline and Market Position

The recent dip reflects a broader bearish trend across major cryptocurrencies. CoinGecko data shows PI’s price slumped to a new record low, while Bitcoin and Ethereum’s movements suggest a market-wide pullback.

- Bitcoin: fell below $88 000.

- Ethereum: briefly dropped to $2 780.

- Pi Network: fell to $0.17.

The drop has intensified concerns about Pi Network’s market viability, especially as the token’s market cap now falls under $1.5 billion.

Token Unlocks and Selling Pressure

A significant factor that could deepen the price decline is the upcoming release of a large volume of Pi tokens.

| Unlock Window | Expected Unlock Volume | Average Unlocks | Record Unlock Day | Tokens Released |

|---|---|---|---|---|

| Next 30 days | ~150 million | ~5 million | February 7 | 6.1 million |

- 150 million tokens are projected to unlock within the next month.

- The average unlock rate is just below 5 million, a higher pace than in previous weeks.

- On February 7, a record 6.1 million tokens were freed.

These unlocks could provide holders with the opportunity to sell, potentially increasing selling pressure on the token.

Future Outlook and RSI Analysis

Pi Network’s Relative Strength Index (RSI) offers insight into potential short-term price movements. The RSI measures whether a token is overbought or oversold, ranging from 0 to 100.

- Below 30: indicates oversold conditions and potential for a rally.

- Above 70: signals overbought territory.

Recently, the RSI fell below 30 and has since risen to 38.

> “We are investigating the cause,” said a spokesperson.

The RSI movement suggests that the worst may be over, hinting at a possible short-term rebound.

Community Sentiment

Despite the recent price decline, some users on X remain optimistic. Kosasi Nakomoto commented that the token’s “earn while you wait” model appears “childish” to many crypto natives, yet predicted that in a couple of years, most people in emerging markets will likely have a Pi wallet.

> “The asset’s ‘earn while you wait’ model looks ‘childish’ to many crypto natives,” said Kosasi Nakomoto.

> “In a couple of years, most people in emerging markets will probably have a Pi wallet.”

The community’s mixed reactions highlight the tension between the token’s current market performance and its long-term adoption potential.

Key Takeaways

- Pi Network’s price fell to $0.17, its lowest level since trading began.

- Market cap dropped below $1.5 billion, ranking the token 75th-largest.

- Upcoming unlocks of nearly 150 million tokens could add selling pressure.

- RSI indicates oversold conditions, suggesting a potential short-term rebound.

- Community sentiment remains divided, with optimism about future adoption in emerging markets.

The combination of a record low price, significant upcoming unlocks, and RSI signals will shape Pi Network’s next market steps.