At a Glance

- Holiday spending expected to hit an all-time $1 trillion.

- Roughly 4 in 10 Americans dip into savings or credit cards during the season.

- About 75% of U.S. households are living paycheck-to-pay and carrying debt.

- Why it matters: Credit-card balances climb as budgets strain, so knowing how to manage debt now can set the tone for the whole year.

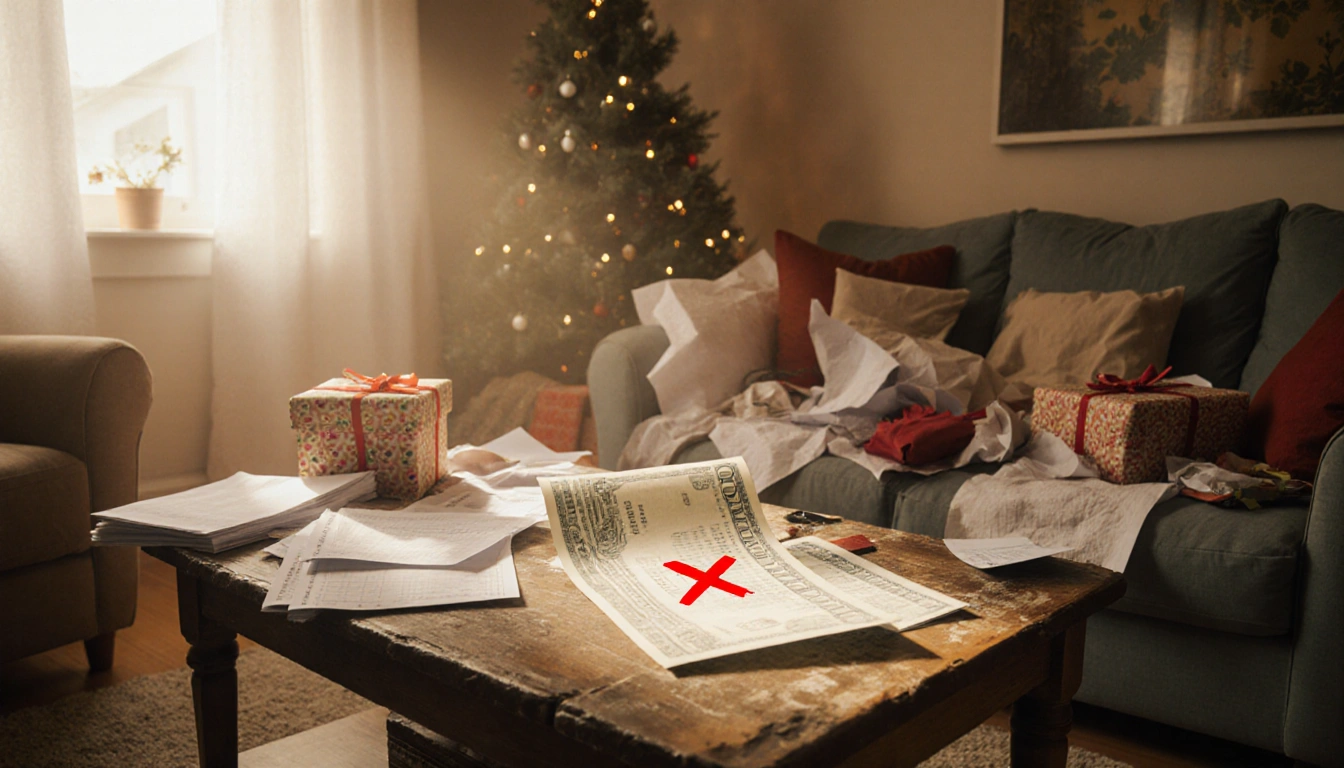

The holiday season is a financial minefield, pushing record spending and debt into the spotlight. With budgets already stretched by tariffs and inflation, many Americans are turning to credit cards and savings to cover gifts, travel, and extra expenses.

Holiday Spending and the Debt Surge

National Retail Federation forecasts holiday spending to exceed $1 trillion, the highest in history.

The surge is fueled by emotional buying, persistent inflation, and the need to meet high expectations.

A AP-NORC poll shows that roughly 4 in 10 Americans dip into savings while shopping.

Debt Management: First Steps

If you overspent this year, the first move is to reach out for help.

- Don’t let shame or guilt keep you from asking for assistance.

- Nonprofits like Savvy Ladies offer free guidance from certified planners.

- Professional advisors can walk you through budgeting and repayment plans.

Lynnette Khalfani-Cox stated:

> “Don’t let shame, guilt, or negative emotions keep you from getting help. You can go reach out to nonprofits, to professionals, to experts who can help you to manage it.”

- Lynnette Khalfani-Cox once carried over $100,000 in credit-card debt, paying it off in just three years.

Take Inventory of Your Debt

Knowing the exact amount owed across credit cards, loans, and buy-now-pay-later plans is like stepping on the scale before a weight-loss plan.

- List every account and balance.

- Note due dates to avoid fees.

- Keep track of interest rates.

Negotiate for Better Rates

A Lending Tree survey found that more than 75% of consumers can secure lower rates simply by asking.

- Contact issuers and request a rate reduction.

- Ask about balance-transfer offers.

- If a debt is in collections, negotiate a settlement or removal.

Choose a Repayment Strategy

While the avalanche method saves money, many find the snowball method easier to sustain.

| Method | Focus | Goal |

|---|---|---|

| Snowball | Smallest balance first | Build momentum |

| Avalanche | Highest interest first | Save on interest |

Pick the debt that causes the most stress and put extra payments toward it. Once cleared, move to the next priority.

Balance Transfers: When to Use Them

A balance transfer can lower your interest rate, but watch for fees and the duration of the 0% APR period.

- Transfer fee: usually 2-3%, sometimes up to 5%.

- Introductory APR length: choose the longest period that fits your payoff plan.

- Read fine print to understand post-APR terms.

- Avoid new balances if you’re tempted to spend more.

The average American has more than $92,000 in debt.

Boost Your Income

Extra cash can make a big difference. Turn unused items into quick money.

- Return unused holiday gifts.

- Sell tech, books, clothing, or furniture online.

- Consider a side gig, like Dennis’s barbershop owner who added grill-master services.

Cut Discretionary Spending

Plan your budget before you click ‘buy.’ Set limits on gifts, outfits, and entertainment.

- Skip pricey gift exchanges; opt for homemade or low-cost swaps.

- Rent formal wear instead of buying for a single event.

- Use group gift ideas like White Elephant to reduce total spending.

Key Takeaways

- Holiday spending tops $1 trillion, pushing many into credit-card debt.

- 75% of households are paycheck-to-pay and carry debt; professional help can ease the burden.

- Strategies like debt inventory, negotiation, payoff methods, and balance-transfer offers can accelerate repayment.

With record holiday spending and tight budgets, taking proactive steps now can help you avoid a debt-filled start to the new year.