Cardano’s recent price slide has drawn attention to a contrasting movement in its investor base. While the token has slipped to around $0.35, a surge of purchases by large holders-often called “whales”-has added significant depth to the market. This article examines the data behind the trend, explores how it could influence the price, and reviews analyst forecasts for the near future.

At a Glance

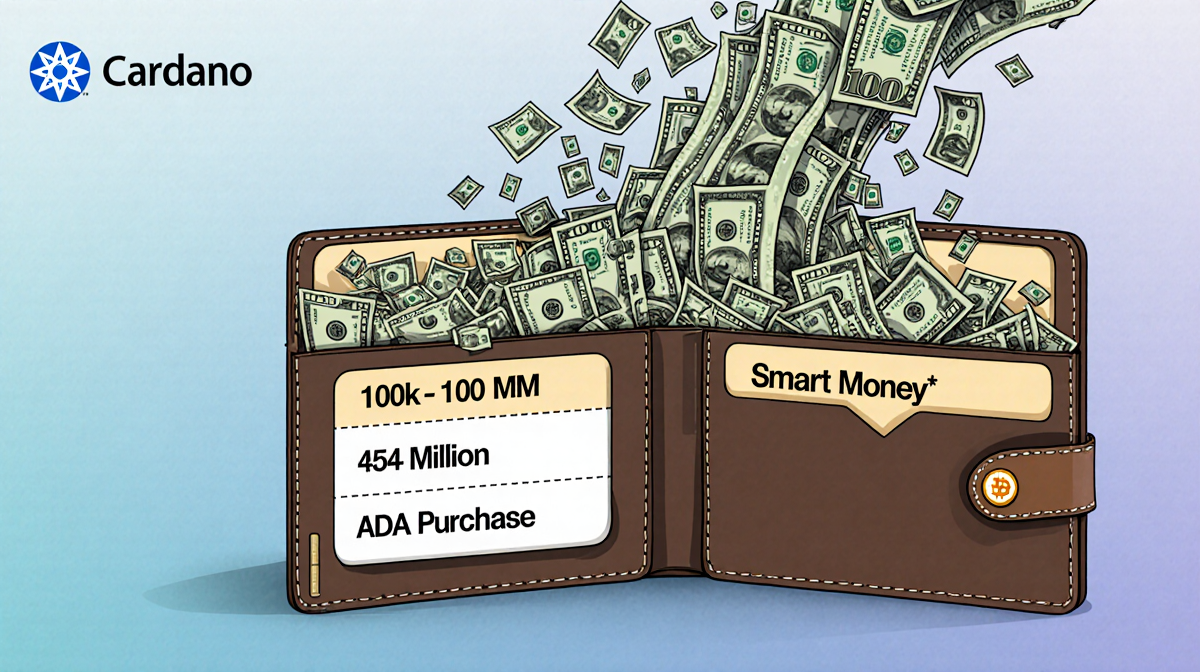

- Whales have bought ~454 million ADA in the last two months, worth about $160 million at current rates.

- Shrimps (small wallets) sold 22,000 ADA in the last three weeks, a drop of roughly 45 % from the token’s three-month high.

- Analysts project a range of upside targets from $0.44 to $3, depending on market sentiment and macro events.

Why it matters: The stark contrast between whale accumulation and shrimp liquidation may signal a shift toward a more stable, potentially bullish environment for ADA.

Whale Activity

Santiment data shows that wallets holding between 100,000 and 100,000,000 ADA-classified as smart money-have purchased more than 454 million ADA in the past 60 days. At the token’s current price of $0.35, that translates to roughly $160 million. This influx of capital is notable because:

- It represents a significant tightening of supply on the open market.

- Large holders typically act on expectations of a catalyst, such as a protocol upgrade or favorable regulatory news.

- Their buying can create a price floor if demand remains steady or increases.

The accumulation pattern is consistent with historical behavior: whales often position themselves ahead of major announcements, positioning the token for a rebound once the event materializes.

Shrimp Selling

In contrast, wallets with 100 coins or fewer-referred to as shrimps-have sold 22,000 ADA in the last three weeks. This activity accounts for a drop of 45 % from the price level seen three months ago. The reasons behind shrimp selling are typically:

- Fear-induced panic during a downtrend.

- A desire to exit before a potential market bottom.

- A lack of conviction in the token’s long-term prospects.

When these smaller investors liquidate, the market discards what analysts describe as “weak hands.” The removal of these positions can leave a more resilient holder base and reduce volatility in the short term.

Market Dynamics

The combination of whale buying and shrimp selling creates a supply-demand imbalance that can be bullish. Key points include:

- Reduced circulating supply due to whale accumulation may support price levels.

- Lowered retail sell-pressure as smaller holders exit could ease downward momentum.

- Potential for a breakout if the token breaches its recent support at $0.34-$0.35.

However, macro-driven events-such as regulatory announcements or global economic shifts-could still override technical patterns. Analysts caution that risk management remains essential.

Price Predictions

Several analysts have issued forecasts based on technical and fundamental analysis:

| Analyst | Key Insight | Target Price |

|---|---|---|

| Surya | “Price is still compressing inside the falling wedge and has pulled back into the $0.34-$0.35 support.” | $0.44 |

| Rose Premium Signals | “ADA’s price has consolidated at a historical demand area with clear accumulation behavior.” | $0.63, $0.93, $1.32 |

| Sssebi | “ADA briefly exploded above $1 after US President Donald Trump initially included the asset in his crypto strategic reserve plans.” | $3 |

Quotes

- “The same thing will happen once the markets start the reversal, and it could be multiple weeks in a row. ADA can get to $3 faster than you think,” said Sssebi.

- Surya warned: “Macro-driven events can invalidate technical setups, so manage risk accordingly.”

These projections span a wide range, reflecting differing assumptions about market sentiment and macro factors. Investors should consider both technical signals and broader economic indicators when deciding on positions.

Key Takeaways

- Whale accumulation has added depth to ADA’s market, potentially setting the stage for a rebound.

- Shrimp liquidation may reduce volatility and strengthen the holder base.

- Analyst forecasts vary from modest upside to a multi-fold increase, underscoring the need for cautious risk management.

- Monitoring macro events remains crucial, as external shocks can quickly alter the technical landscape.

By keeping an eye on both whale activity and market sentiment, investors can better navigate the current volatility and position themselves for potential upside in Cardano’s next move.