At a Glance

- Tesla’s global deliveries fell 9% to 1.63 million in 2025.

- Q4 sales dropped 15.6% to 418,227 units, missing analyst expectations.

- The U.S. federal tax credit removal drove a 29% Q3 surge that quickly reversed.

- Why it matters: Tesla’s sales slump signals a shift in the EV market and challenges the company’s growth plans.

Tesla’s 2025 sales figures confirm a second straight year of decline, with deliveries falling 9% from the previous year and a sharp drop in the fourth quarter. The loss is linked to the removal of the U.S. federal tax credit and rising competition, especially from Chinese automaker BYD.

Sales Decline

Tesla delivered 1.63 million vehicles worldwide in 2025, down 9% from 1.79 million in 2024. Of those, 50,850 were classified as “other models,” including the Cybertruck, Model X and Model S.

Quarter-over-quarter, the company shipped 418,227 cars in Q4, a 15.6% drop versus the same period last year and well below analysts’ forecasts.

- Q4 deliveries: 418,227 cars

- YoY drop: 15.6%

- Stock fell >2% after the New Year

Competition & Market Share

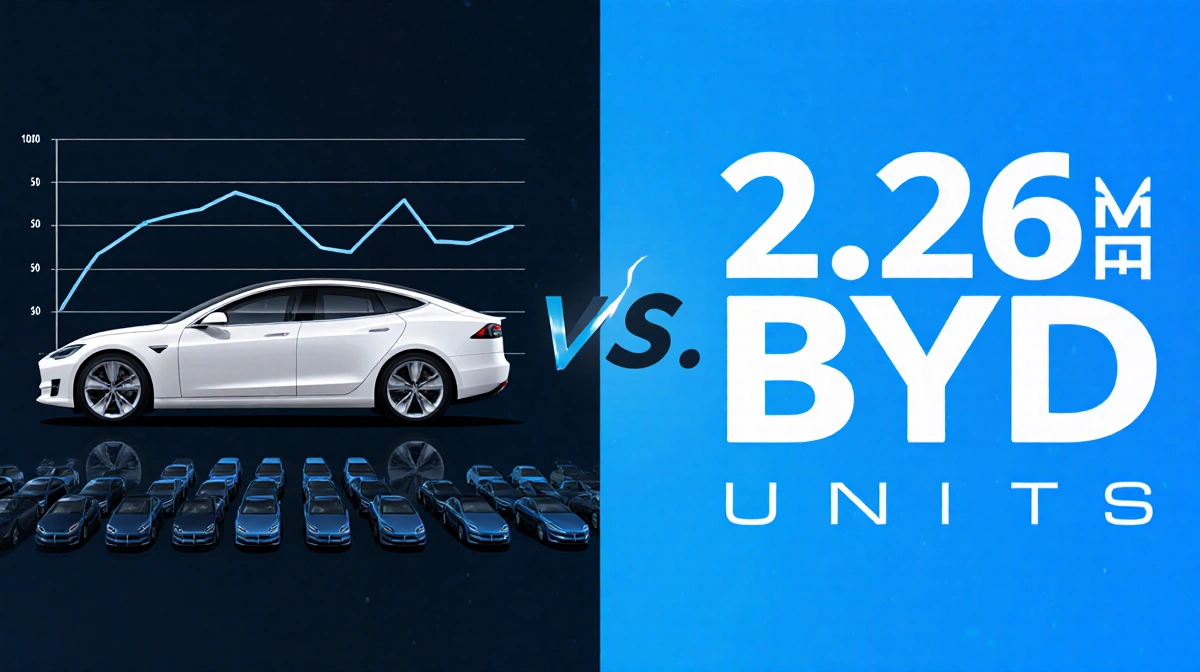

Chinese automaker BYD now tops global EV sales, delivering 2.26 million units in 2025, surpassing Tesla’s output.

Tesla’s market share in Europe and China has eroded, while U.S. competition remains domestic, as Chinese automakers are barred from selling there.

Strategic Shift

CEO Elon Musk is steering Tesla toward AI and robotics, framing the company’s future around the Master Plan IV concept of “sustainable abundance.”

Despite the shift, Tesla’s core revenue remains dominated by EV sales, with $28 billion in Q3 revenue, of which $21.2 billion came from vehicles.

- Q3 revenue: $28 billion

- EV revenue: $21.2 billion

Key Takeaways

- Tesla’s 2025 deliveries fell 9% and Q4 sales slid 15.6%.

- The removal of the U.S. federal tax credit caused a 29% Q3 spike that quickly reversed.

- BYD now leads global EV sales, prompting Tesla to pivot toward AI and robotics.

With sales declining and competition intensifying, Tesla’s pivot to AI and robotics may be a response to a changing market, but its vehicle revenue remains the company’s financial backbone.