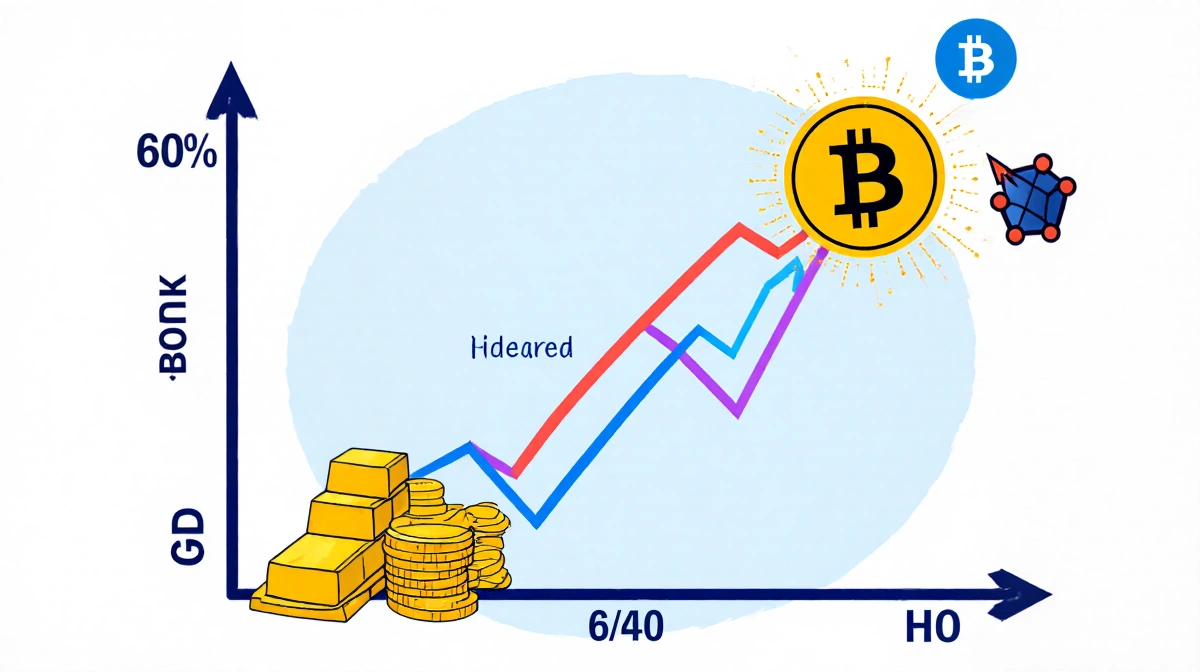

Bitwise research shows holding both bitcoin and gold delivers stronger risk-adjusted returns than traditional portfolios during market cycles.

At a Glance

- A 60/40 portfolio with 15% split between bitcoin and gold achieved a Sharpe ratio of 0.679

- Gold limited losses during drawdowns while bitcoin led recovery rallies

- The combo portfolio’s Sharpe ratio was nearly three times higher than standard 60/40

- Why it matters: Investors seeking inflation protection may benefit from holding both assets rather than choosing one

Bitcoin and gold are often framed as rivals in the inflation-hedge arena, yet fresh data from Bitwise argues the real edge lies in pairing them. A new report by Senior Investment Strategist Juan Leon and Quantitative Research Analyst Mallika Kolar finds that a dual allocation smooths volatility while amplifying recoveries.

Gold Cushions, Bitcoin Catapults

The study examined major market downturns since 2018, comparing a classic 60/40 stock-bond mix against versions that layered in gold, BTC, or both. Gold repeatedly acted as a defensive buffer:

- 2018 equity drawdown: stocks fell 19.34%, BTC dropped more than 40%, gold gained 5.76%

- 2020 COVID shock: equities slid 34%, BTC declined 38.1%, gold dipped only 3.63%

- 2022 macro rout: stocks fell 24.18%, BTC tumbled nearly 60%, gold limited its loss to under 9%

- 2025 trade-tension pullback: equities dropped 16.66%, BTC fell 24.39%, gold rose almost 6%

During the rebounds that followed, bitcoin delivered outsized gains: roughly 79% after the 2018 bottom, a 775% surge following 2020 lows, and a 40% rise in 2023 as inflation cooled. Gold also climbed in recoveries, though less dramatically, while equities rebounded strongly.

Sharpe Ratio Winner

Across full drawdown-recovery cycles, the portfolio that allocated 15% jointly to gold and bitcoin produced a Sharpe ratio of 0.679, nearly triple the 60/40 baseline and well above a gold-only enhancement. A bitcoin-only sleeve posted a higher Sharpe ratio but carried significantly higher volatility.

The analysis was prompted by recent comments from Bridgewater Associates founder Ray Dalio, who recommended a combined 15% allocation to gold and BTC amid rising U.S. federal debt and persistent deficit spending, factors he says increase the risk of long-term currency debasement.

Bitwise concludes that investors seeking shelter from dollar debasement and market swings may gain more by holding both assets rather than treating them as mutually exclusive choices.