> At a Glance

> – Bitcoin touched $93,000 Monday, its highest level in three weeks

> – Move follows a weekend US strike on Venezuela

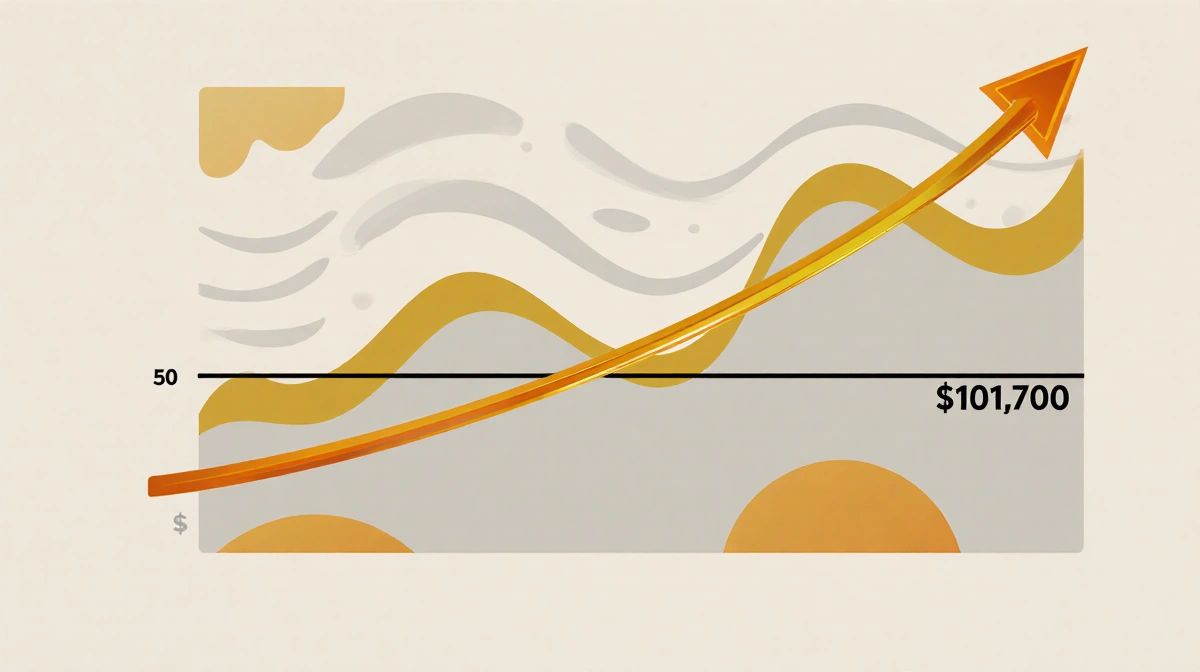

> – Analysts eye $101,700 next if pattern mirrors 2022 Ukraine response

> – Why it matters: Crypto traders are betting geopolitical shocks will extend the rally toward six-figure territory

Bitcoin is staging its sharpest rebound since early December after a weekend military strike thrust Venezuela back into global headlines.

BTC briefly hit $93,000 during Asian trading hours and now sits just below that level, up more than 6% since the year began. The move has traders recalling early 2022, when Russia’s invasion of Ukraine sent Bitcoin up 22% in weeks.

Historical Echoes

Michael Nadeau of The DeFi Report sees the 50-week moving average-currently $101,700-as the next magnet:

> “In the current environment, I’ve been anticipating a move for BTC back up to the 50-week moving average … Now we have a catalyst.”

He warns the same line could become resistance once reached.

Bear-Market Bounce Theory

Not everyone reads the surge as a new uptrend. Veteran trader Aaron Dishner calls it the “start-of-bear-market bounce”:

- Early-January rallies happened in 2015, 2018 and 2022

- Tax-year position squaring in December often leads to January buy-backs

- His target remains $100k before the next leg down

> “This happens at the start of every past bear market … This time is no different to me.”

Technical Hurdles Ahead

Joe Consorti, analyst at The Bitcoin Layer, notes BTC has reclaimed its 50-day moving average for the first time since October:

> “Sell pressure may be nearing exhaustion. Need to reclaim and hold the 50-week MA at $101k.”

For now, Bitcoin faces stiff resistance just above $94,000. A daily close beyond that level would break a six-week sideways channel and open the door to the psychologically key $100k zone.

Key Takeaways

- Geopolitical shock provided the spark, but $94k is the technical line in the sand

- Historical analogs point to possible $101k retest before renewed selling

- Trader positioning and tax-season flows add seasonal tailwinds through January

- Bitcoin is already up 6.24% in 2026’s first week

Whether the rally sustains likely depends on the next macro headline-and Bitcoin’s ability to turn the $101,700 zone from resistance to support.