> At a Glance

> – Bitcoin has broken out of a multi-week descending channel

> – Next major hurdle sits at $94K-$96K resistance cluster

> – 4-hour chart shows price wedging into a tightening range

> – Why it matters: A daily close above $96K could open a new leg higher; failure risks a swift drop toward $80K

Bitcoin is knocking on the door of a key resistance zone after clawing its way out of a month-long descending channel, but momentum is still too tepid to trust the move without confirmation.

Daily Breakout Lacks Conviction

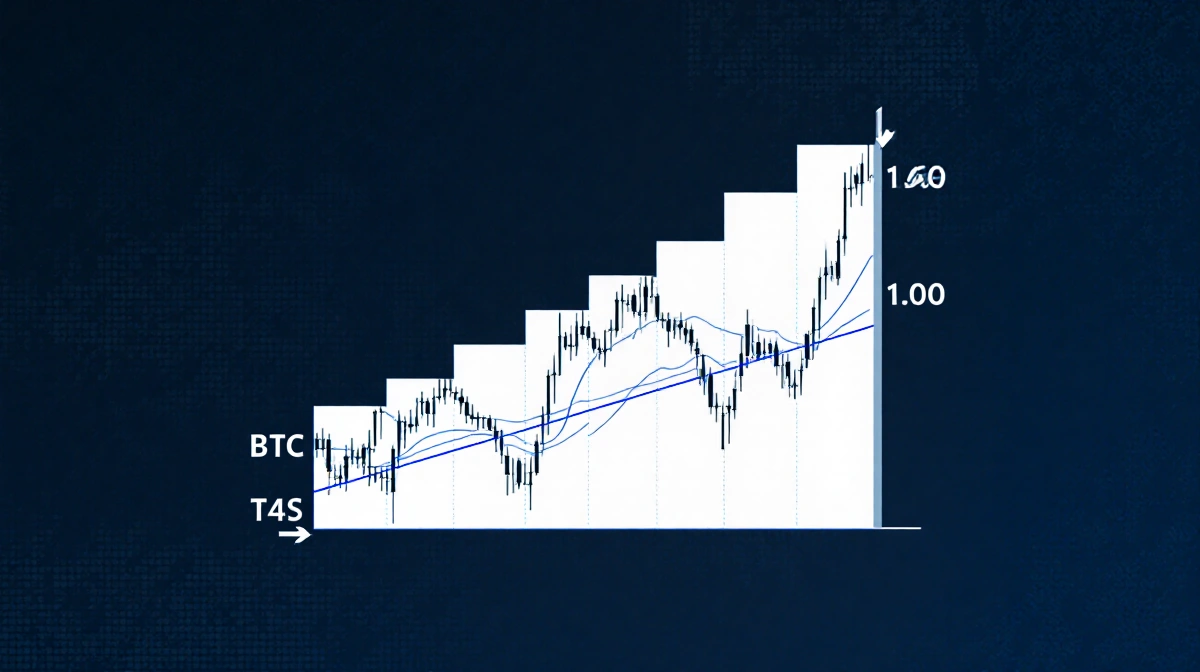

The daily candle structure shows BTC has technically escaped the pattern of lower highs that trapped price since late December. Yet each session’s trading range remains thin, signaling buyers are not yet willing to press the advantage.

The $94K-$96K region is the first serious supply wall on the way up. This area previously absorbed heavy volume and is now the line in the sand separating a corrective bounce from a resumption of the broader up-trend. Until the market records sustained acceptance above this level with expanding volatility, the breakout carries a high false-break risk.

4-Hour Compression Flags Incoming Expansion

Zooming in, BTC is coiling inside a symmetrical wedge on the 4-hour chart. Higher lows are forming, but local resistance keeps capping rallies, compressing price into an ever-narrower band.

- A measured breakout above $95K on strong volume would target the highs near $108K

- Failure could quickly redirect order flow toward the cluster of leveraged longs between $85K-$87K, a zone that doubled as a liquidity magnet on the heatmap

| Scenario | First Target | Key Invalidation |

|---|---|---|

| Bullish breakout >$95K | $100K-$102K | Daily close back <$93K |

| Bearish breakdown <$88K | $84K-$80K | 4-h close >$92K |

Sentiment: Stops, Not Trends, Are Driving Price

The liquidation heatmap reveals a thick pocket of leveraged positions beneath spot price. A sudden sweep of the $85K-$87K region could trigger cascading liquidations and accelerate downside momentum.

Conversely, overhead liquidity is sparse, implying an upward squeeze would need fresh buying rather than stop-losses alone. The recent grind has already chewed through minor short liquidations without generating follow-through, underscoring the market’s directional indecision.

Key Takeaways

- Daily descending channel breakout is technically constructive but unconfirmed

- $94K-$96K resistance must be reclaimed on rising volume to justify bullish bias

- 4-hour wedge compression warns of an imminent 3%-5% move either direction

- $85K-$87K liquidity pool acts as a downside magnet if support fails

- Until a decisive break occurs, expect choppy, range-bound action driven by stop-hunts

Traders should watch for a 4-hour candle close beyond the wedge boundary; anything else keeps Bitcoin locked in no-man’s-land between $88K and $96K.