At a Glance

- Celestica (CLS) reclaimed its 50-day moving average in heavy Tuesday volume

- Options traders are targeting bull put spreads to capture further upside

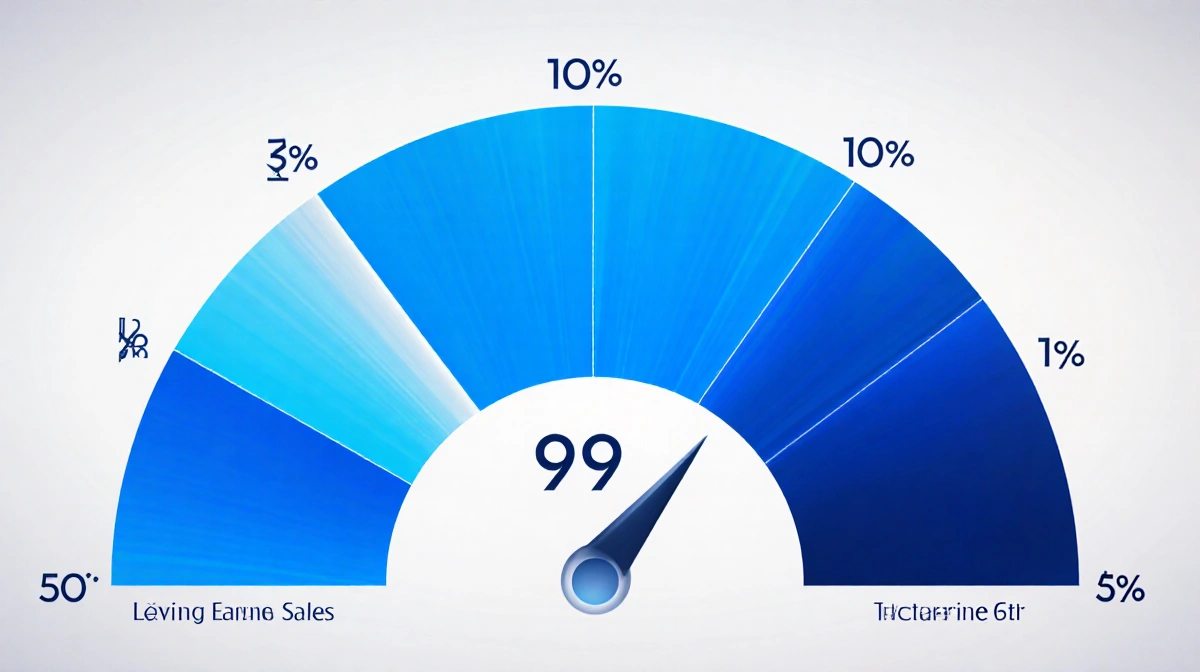

- Stock earns highest possible IBD Composite Rating of 99

- Why it matters: Strong technical momentum and AI data-center demand could push shares higher

Celestica shares are back above a closely watched technical level, and options traders are positioning for more gains in the data-center and AI hardware supplier.

Stock Reclaims 50-Day Line

The Toronto-based electronics manufacturer popped back above its 50-day moving average during Tuesday’s session. Volume on the breakout was tracking more than double the stock’s daily average, underscoring institutional interest.

Celestica supplies servers, storage, and networking gear that power cloud and artificial-intelligence workloads. Customers include hyperscale data-center operators and OEMs building AI clusters.

Highest Composite Rating

News Of Los Angeles data show Celestica holds a perfect Composite Rating of 99, the best-possible score. The metric blends earnings growth, sales growth, and relative price strength into a single 1-to-99 figure.

Shares have rallied roughly 45% year-to-date, far outpacing the S&P 500. The relative strength line, which measures performance versus the broader market, is near multi-year highs.

Options Strategy: Bull Put Spread

Traders bullish on continued momentum can use a bull put spread, a defined-risk options strategy. The setup involves:

- Selling a higher-strike put

- Buying a lower-strike put with the same expiration

- Collecting a net credit upfront

Maximum profit equals the credit received; maximum loss is the difference between strikes minus the credit.

Example Setup

With Celestica near $67, an investor could:

- Sell the June $65 put for ~$2.50

- Buy the June $60 put for ~$1.00

- Net credit: $1.50 per spread

Profit window: Shares stay above $65 through expiration.

Break-even: $63.50 at expiration.

Loss zone: Below $60, capped at $3.50 per spread.

Risk Management

Because the short put is partially covered by the long put, margin requirements are limited. Traders still face potential assignment if the stock settles below the short strike at expiration.

Position size should reflect individual risk tolerance. Most brokers allow spreads in retirement accounts, but assignment risk remains.

Earnings Catalyst Ahead

Celestica is expected to report second-quarter results in late July. Management guided Q2 revenue between $2.35 billion and $2.55 billion, implying double-digit growth year-over-year.

Analysts see adjusted profit of $0.84 per share, up 30% versus the prior year. Any guidance raise could fuel the next leg higher.

Supply-Chain Tailwinds

The company is benefiting from:

- AI server demand: Hyperscalers upgrading GPUs and accelerators

- On-shoring trends: North American assembly capacity wins

- Component availability improving after two years of shortages

These factors are expanding gross margins, which hit 10.2% last quarter, a 190 basis-point jump from the year-ago period.

Technical Levels to Watch

- 50-day MA: Currently $64.80 and rising

- Prior high: $71.29 from March

- Support: Congestion near $62-$63

A close above the March peak would mark a fresh 52-week high and could trigger additional momentum buying.

Institutional Ownership Rising

Funds added 3.2 million net shares last quarter, according to News Of Los Angeles data. Top holders include:

| Holder | Shares (M) | % Float |

|---|---|---|

| Fidelity | 11.4 | 9.8% |

| Vanguard | 9.7 | 8.3% |

| BlackRock | 8.1 | 7.0% |

Short interest is a modest 4% of the float, reducing potential squeeze fuel.

Key Takeaways

- Celestica’s breakout above the 50-day comes on surging volume

- Composite Rating of 99 signals strong fundamentals and technicals

- Bull put spreads offer a limited-risk way to play continued strength

- Next catalyst is July earnings, where guidance could exceed expectations