> At a Glance

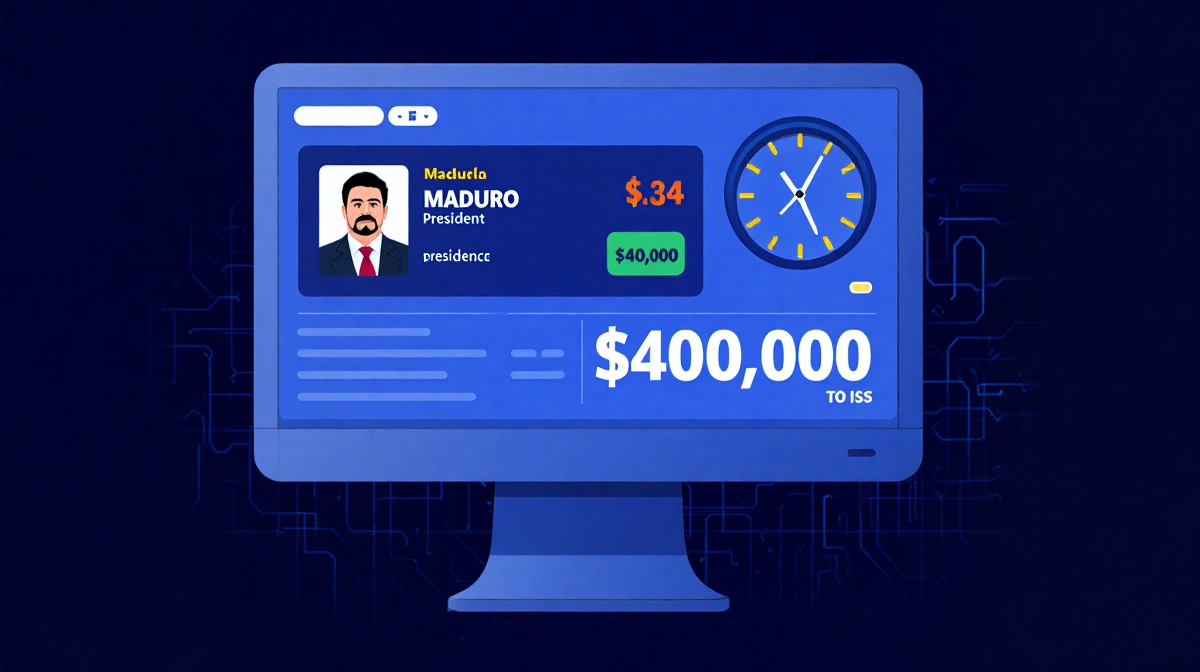

> – A Polymarket user turned $33,934 into $400,000+ by betting the U.S. would topple Nicolás Maduro before February

> – The final $14,000 wager landed hours before Saturday’s special-forces capture

> – Chainalysis says the winner cashed out in Solana through a major U.S. exchange without laundering attempts

> > Why it matters: The timing raises fresh fears that prediction markets are becoming a playground for anyone with access to classified U.S. military plans.

A single Polymarket account placed 13 bets between Dec. 27 and Jan. 3, all pegged to American military action in Venezuela. When U.S. forces seized President Nicolás Maduro and his wife before dawn Saturday, the long-shot market resolved-and the anonymous bettor walked away with a six-figure profit.

The Bets That Beat the Pentagon

Polymarket’s public ledger shows the account concentrated every dollar on two linked outcomes: a U.S. invasion and Maduro’s removal. The largest chunk, $14,000, was staked late Friday night-after Defense officials told News Of Los Angeles the launch day had finally been locked in but before any public word leaked.

- Total wagered: $33,934.34

- Total won: ≈ $400,000

- Cash-out method: Solana via a U.S. exchange

- Privacy moves: None visible, per Chainalysis

Four More Accounts Ride the Same Hunch

At least four smaller users bet $700-$900 between Thursday and Saturday on Maduro simply being out of office by Jan. 31. Each cleared $7,000-$14,000 once the market settled, though there is no evidence they had inside information.

| Account Type | Wager Range | Profit Range | Bet Window |

|---|---|---|---|

| Main suspect | $14,000 (final) | $400,000+ | Fri. night |

| Four others | $700-$900 | $7,000-$14,000 | Thu.-Sat. |

Regulatory Spotlight Returns

Prediction markets operate in a legal gray zone. Polymarket once barred Americans under CFTC pressure, but the agency dropped its probe last summer and approved the platform as a U.S. exchange in November. Users still check a box claiming they are “not a U.S. person,” yet American-friendly roll-outs have begun.

Rep. Ritchie Torres (D-N.Y.) plans to introduce the Public Integrity in Financial Prediction Markets Act of 2026, making it a crime to trade on non-public information in these venues.

David Chase, ex-SEC attorney, says using classified knowledge for commodity-like bets is “generally considered fraud,” but courts have yet to catch up with the fast-growing sector.

Key Takeaways

- One bettor perfectly timed a $400K payout on Maduro’s removal

- The wager landed after Pentagon insiders knew the raid date

- Funds were withdrawn in Solana through a U.S. exchange with no laundering tricks

- Lawmakers are preparing rules to criminalize trading on secret government plans

The episode shows how prediction markets can turn state secrets into public jackpots-long before voters, allies, or even most troops know what is coming.