> At a Glance

> – ETH is pinned below $3,000 after repeated failed break-outs

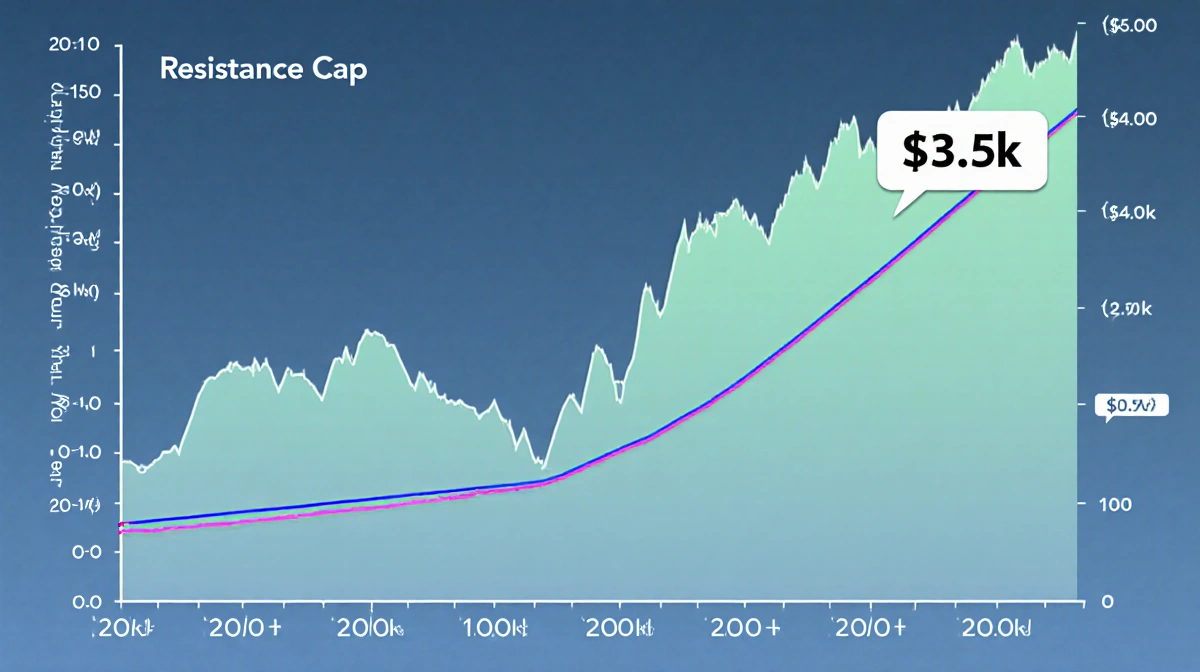

> – Daily chart shows wide $2.7k-$3.5k range with $3.5k MA wall

> – 4-hour $3.1k “order block” rejected latest push

> – Why it matters: A sweep of fresh derivatives longs is likely unless bulls reclaim $3.5k quickly

Ethereum’s recovery has stalled near the psychological $3,000 mark and on-chain order flow is flashing warning signs.

Daily Chart Outlook

Price remains locked inside a $2.7k-$3.5k box. The 100- and 200-day moving averages converge near $3.5k, acting as dynamic resistance and capping every rally attempt.

- $3.5k reclaim = minimum condition for bull reversal

- $2.7k demand zone still the downside magnet

- Daily RSI is climbing but not yet overbought

Unless buyers flip $3.5k back to support, risk of rejection back toward mid-range or the $2.7k floor stays elevated.

Intraday Rejection

Zooming into the 4-hour timeframe shows ETH briefly poked a known bearish order block at $3.1k before sellers re-emerged.

| Key Metric | Current | Notes |

|---|---|---|

| Local Resistance | $3.1k | Bearish order block |

| Local Support | $2.8k | Higher-low structure |

| 4-h RSI | Overbought | Short-term pullback cue |

The sequence of higher lows since mid-December keeps the intraday structure bullish, but another failure here targets $2.8k support.

Derivatives Hint at Positioning Trap

Open-interest has rebounded sharply after months of decline, showing traders are opening fresh longs ahead of an expected breakout.

- Rising OI + flat price = potential positioning squeeze

- Momentum remains fragile while fundamentals unchanged

- Flush risk grows if $3k collapses under selling pressure

Key Takeaways

- $3.5k is the line in the sand for trend reversal

- $2.8k is the first intraday support on rejection

- Derivatives positioning raises odds of a long squeeze

For now ETH remains range-bound; direction will hinge on which side of the $2.7k-$3.5k bracket gives way first.