At a Glance

- More than 200,000 European banking jobs could vanish by 2030 as AI and branch closures reshape the sector.

- The cuts represent roughly 10% of the workforce across 35 major banks.

- Back-office, risk management and compliance are the hardest hit, with banks eyeing 30% efficiency gains.

- Why it matters: Millions of banking staff face layoffs, and the shift could reshape how banks operate worldwide.

A new Morgan Stanley analysis, highlighted by the Financial Times, warns that AI adoption and the shuttering of physical branches could cut more than 200,000 jobs in European banks by 2030.

AI-Driven Restructuring

The report points to back-office, risk management and compliance as the most vulnerable areas, where algorithms can process data faster than humans. Banks anticipate up to 30% efficiency gains, making the cuts seem attractive.

The trend is not limited to Europe. In October, Goldman Sachs announced a hiring freeze and job cuts in the U.S. as part of its OneGS 3.0 AI push, targeting client onboarding and regulatory reporting.

Institutions Taking Action

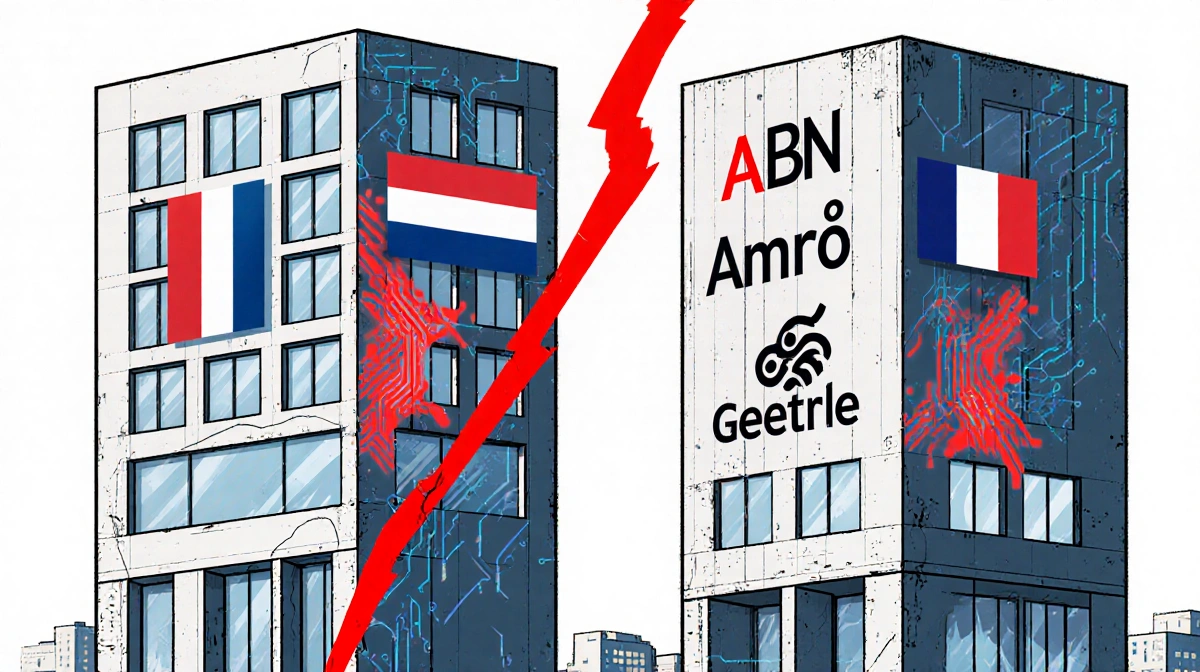

Dutch lender ABN Amro plans to cut a fifth of its staff by 2028, while Société Générale‘s CEO declared “nothing is sacred.”

Société Générale CEO stated:

> “nothing is sacred.”

Some leaders warn against rushing the transition. A JPMorgan Chase executive told the FT that if junior bankers never learn the fundamentals, it could backfire.

JPMorgan Chase exec said:

> “if junior bankers never learn the fundamentals, it could come back to haunt the industry.”

Timeline of Key Moves

| Event | Date | Detail |

|---|---|---|

| AI-Driven Job Cuts in Europe | 2030 | >200k jobs, 10% workforce |

| ABN Amro staff reduction | 2028 | cut 20% of staff |

| Goldman Sachs hiring freeze | Oct 2025 | job cuts and freeze through end 2025 |

These actions illustrate the growing pressure on banks to streamline operations through technology.

Key Takeaways

- More than 200,000 jobs at risk by 2030.

- Back-office, risk and compliance face the biggest cuts.

- Banks target up to 30% efficiency gains, sparking debate over skill loss.

The wave of AI-driven layoffs signals a major shift in the banking sector, with efficiency gains weighed against the human cost and potential skill gaps.