Ethereum remains in a corrective, range-bound environment after failing to sustain the early-month advance above the mid-$3,500s. The price action oscillates between a higher-timeframe demand cluster in the $2,700 region and a broad supply band closer to $3,500, while the main moving averages continue to cap the upside. This structure keeps directional conviction limited and increases the importance of reaction at the nearby support zones during the current pullback.

At a Glance

- Ethereum stuck between $2,700 support and $3,800 resistance.

- Daily chart shows repeated rejection at $3,500 and 100-day MA.

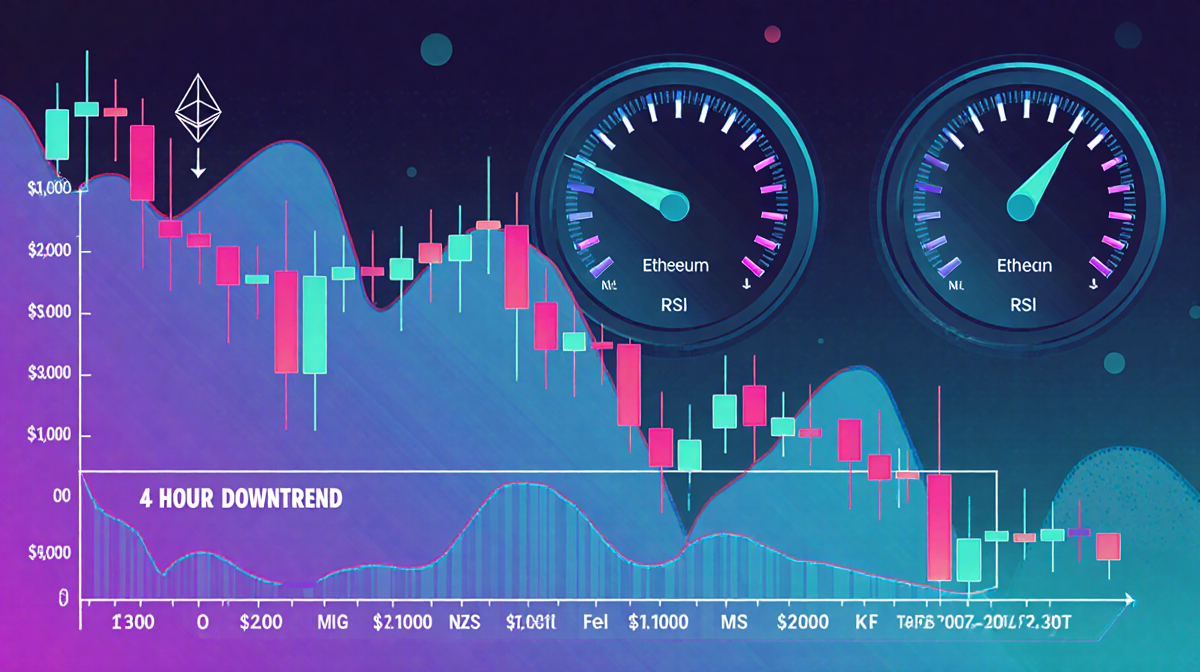

- 4-hour chart confirms a clear downtrend after breaking the $3,000-$3,100 channel.

Daily Chart Analysis

On the daily chart, Ethereum has been rejected once again from the confluence of the $3,500 resistance block and the declining 100-day moving average. The 200-day moving average remains positioned higher around $3,800 and is turning sideways, reinforcing a neutral stance over the longer horizon. The sell-off below the 100-day moving average confirms that the primary trend remains corrective rather than impulsively bullish, and the focus shifts to the green $2,700 demand region as the next critical area.

A sustained hold above that zone would prevent a bearish continuation and keep open the possibility of another attempt toward the $3,500 mark. Meanwhile, a daily close below the $2,700 zone would indicate a deeper mean-reversion phase toward the lower support band near $2,200.

| Level | Description |

|---|---|

| $3,800 | 200-day moving average (sideways) |

| $3,500 | Resistance block & 100-day MA |

| $2,700 | Demand cluster (green zone) |

| $2,200 | Lower support band |

The 200-day moving average at $3,800 serves as a long-term ceiling, while the 100-day moving average at $3,500 is a short-term hurdle that price must clear before moving higher.

4-Hour Chart Analysis

The 4-hour chart shows a clear breakdown from the rising channel that carried the price from approximately $2,800 to the recent peak near $3,400. After losing the channel’s lower boundary and the local support around $3,000-$3,100, Ethereum is now trading in a clear downtrend characterized by lower highs and lower lows. Momentum gauges such as the RSI recover modestly from oversold territory, but the overall trend remains bearish.

The immediate tactical pivot sits around the former breakdown zone at $3,000-$3,100. Recovery and consolidation back above this area would suggest a failed breakdown and open a path back toward the $3,400, while continued rejection there would keep pressure on support levels closer to $2,900 and then the higher-timeframe demand at $2,600-$2,700.

The RSI’s modest recovery from oversold territory suggests that momentum may not be fully exhausted, yet the prevailing downtrend indicates that sellers remain in control.

Sentiment Analysis

The Coinbase Premium Index for Ethereum has shifted decisively negative over recent weeks, with persistent red readings indicating that spot prices on Coinbase trade at a discount compared to Binance. This configuration signals relatively weaker buy-side interest from U.S. and institutional-leaning participants and often aligns with phases of distribution or cautious positioning in that cohort.

Historically extended negative premiums can coincide with exhaustion of local selling pressure as weaker hands capitulate to more aggressive offshore demand, setting the stage for a later recovery once macro liquidity or narrative drivers improve. For the moment, however, the sustained discount reinforces the view that the current downswing is driven not only by technical rejection at resistance but also by a conservative bias among U.S. spot flows.

A negative Coinbase Premium Index signals that U.S. spot buyers are pricing Ethereum lower than Binance, a pattern that often precedes a consolidation or reversal once offshore demand strengthens.

Special Offer

SECRET PARTNERSHIP BONUS for News Of Los Angeles readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer). Disclaimer: Information found on News Of Los Angeles is those of writers quoted. It does not represent the opinions of News Of Los Angeles on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

This partnership bonus is only available to readers of News Of Los Angeles and is subject to the terms and conditions of BingX Exchange.

Overall, Ethereum is trapped between key resistance and support levels, with technical and sentiment indicators pointing to a pause before a potential breakout. Traders should monitor the $2,700 and $3,500 zones closely for any shift in momentum.