At a Glance

- The FCC banned all new foreign-made drones and critical components from U.S. markets late December.

- China builds 70-90% of U.S. drones; DJI alone holds over two-thirds of America’s personal and commercial market.

- Prices for hobbyists, consumers, and businesses are expected to spike as domestic supply chains remain nascent.

- Why it matters: American users face higher costs, limited availability, and stalled innovation as the country scrambles to rebuild its drone industry.

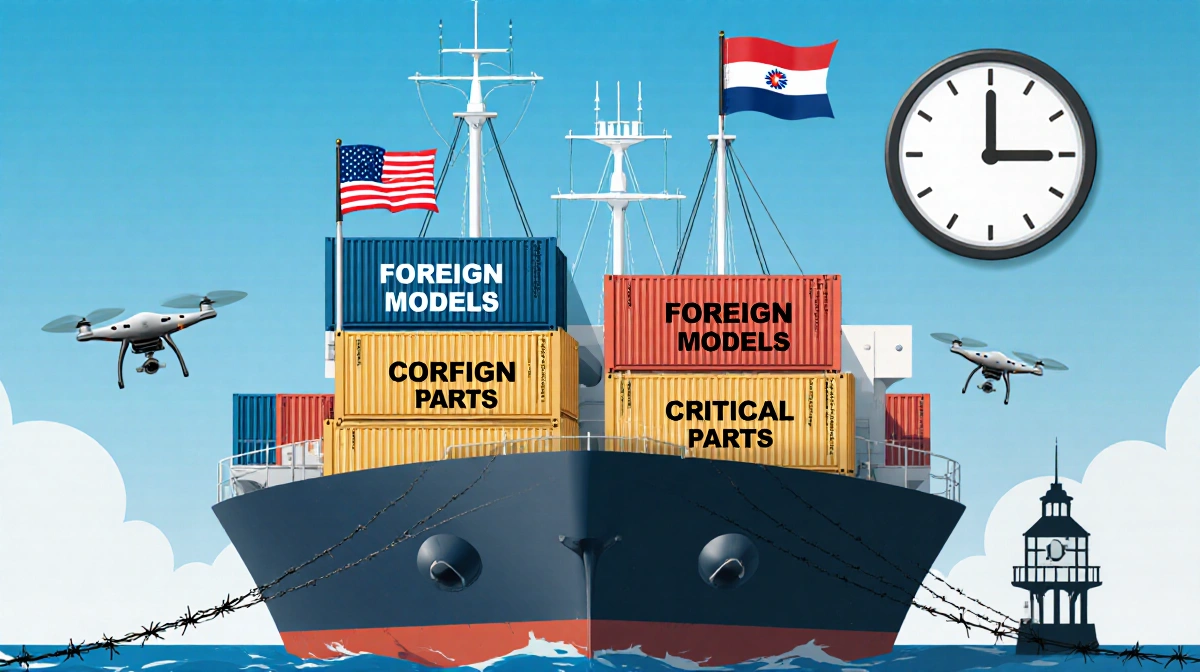

The Federal Communications Commission delivered a jolt to the drone world in late December, announcing an immediate ban on new models of foreign-made drones and critical components. The ruling, framed as a national-security imperative, is already reshuffling America’s $10 billion drone market and threatens to drive up prices for everyone from weekend hobbyists to Fortune 500 firms.

A Market Built Abroad

America’s dependence on Chinese hardware is staggering. Industry estimates place China’s share of U.S. drone sales between 70% and 90%, with Shenzhen-based DJI controlling well over two-thirds of the personal and commercial segments. Out of 837,000 drones registered with the Federal Aviation Administration as of 2025, the vast majority trace their supply chains to Chinese factories.

Chris Larson, CEO of U.S. component maker Standard Systems, minced no words. “It’s an absolute s—show. It’s terrible. The United States doesn’t make any drone components,” he told Amanda S. Bennett. Larson, a special-operations veteran, said domestic options “only popped upwards over the last couple years.”

How the Ban Works

The FCC order, amended on January 7, bars new foreign models from entering the U.S. but allows existing inventories to stay on shelves for one additional year. After that grace period, every new drone or critical part sold must originate from an American factory or an allied country deemed secure.

Key points:

- Motors, batteries, sensors, and radios must be domestically sourced

- Already-owned foreign drones remain legal to fly

- Replacement parts for current models can still be imported-for now

- Federal agencies have lived under similar restrictions since the 2023 American Drone Security Act

Price Shock Ahead

With domestic production still embryonic, analysts predict sticker shock. “The reality is, in the drone world, everything is made in China, and it’s going to take some time for things to get ramped up here,” Larson said.

Survey data from the Association for Uncrewed Vehicle Systems International shows only 13% of public-safety drone fleets include U.S.-made Skydio aircraft, versus 97% that fly DJI hardware. Swapping to American alternatives could double or triple acquisition costs for police and fire departments already facing tight budgets.

Olaf Hichwa, co-founder of defense startup Neros Technologies, expects the pain to spread fast. “My personal hobby will get more expensive. My drones will probably get worse and harder to buy,” he told News Of Los Angeles. Hichwa, also a competitive drone racer, warned: “Anyone who says that this is going to be easy probably doesn’t understand the problem fully. Industrial bases are not built overnight.”

Inside the Supply Chain Bottleneck

Rare-earth minerals such as neodymium and dysprosium, essential for lightweight motors, are overwhelmingly refined in China. American machine shops can produce alternatives, but at a premium. Ben Barani, COO of Standard Systems, said U.S. firms shoulder the full burden of R&D and overhead, while Chinese competitors benefit from heavy state subsidies.

Table: Component Availability

| Component | China Options | U.S. Options |

|---|---|---|

| Motors | 20+ suppliers | 1-2, high cost |

| Batteries | Integrated supply | Limited cell vendors |

| Sensors | Mass-market pricing | Boutique, 3× price |

| Frames | Carbon-fiber clusters | Small batch shops |

Larson summarized the mismatch: “In China you get competitive bids across the street. In the U.S. I might have one supplier, and they know they have pricing power.”

Startups Rush In

The policy shake-up has triggered a gold-rush mentality among investors. Susan Roberts, VP of strategy at Ondas Holdings, said the ban “accelerates clarity” and funnels capital toward companies that control software, data paths, and lifecycle support. Startups such as Purple Rhombus and Neros are scaling fast:

- Purple Rhombus plans sheet-metal drones at thousands per month within two years

- Neros already produces tens of thousands annually and targets 325 per day soon

- Both firms cite Ukraine’s drone-dominated battlefield as proof that cheap, expendable American airframes are now strategic

Mike Benitez, a former Pentagon official who just became Purple Rhombus CEO, argued the national-security and economic arguments have merged. “Millions of drones on both sides of the war” run Chinese parts, he noted. Building a U.S. alternative “makes sense not just for national security, but ultimately for all of the industries in the United States.”

Timeline of Escalation

| Date | Action |

|---|---|

| 2023 | American Drone Security Act bars federal purchases of foreign drones |

| July 2024 | White House executive order pushes domestic drone dominance |

| Late Dec 2024 | FCC announces sweeping import ban |

| Jan 7 2025 | FCC grants one-year sales extension for certain brands |

| 2026 | Import window closes; domestic quota requirements begin |

Winners and Losers

Likely Winners

- Skydio, Neros, and other U.S. assemblers

- Machine shops pivoting to drone-grade parts

- Investors holding shares in domestic supply chains

Immediate Losers

- Agricultural inspectors who rely on $500 DJI quadcopters

- Real-estate photographers needing light, long-battery aircraft

- Police departments with thin capital budgets

Scott Shtofman, VP for regulatory affairs at the drone trade group, said the breadth-not the concept-of the ban startled industry. “The scale of automated, autonomous production lines that you’d see in China, we don’t have that,” he told News Of Los Angeles.

The Long Game

Executives across the emerging U.S. ecosystem predict a two-to-three-year scramble before American factories approach Chinese scale. Even then, prices may stay elevated. Hichwa, whose firm was sanctioned by Beijing for supplying Taiwan, insists the effort is worth it. “Without a domestic drone industrial base, modern countries cannot defend themselves,” he said.

The FCC ruling, he added, is “one of the first efforts I’ve seen that actually puts weight behind this true push toward building and buying American-made systems.”

Key Takeaways

- Expect higher prices and limited selection for at least 24-36 months

- U.S. manufacturers are ramping, but rare-earth bottlenecks persist

- Federal, state, and local agencies must budget more for American alternatives

- Investors are pouring capital into startups promising cheap, mass-produced domestic drones

- The policy links hobbyist convenience to battlefield survivability, making compromise unlikely