> At a Glance

> – Hayden Adams counters claims AMMs are unsustainable

> – Says AMMs quietly beat pros where capital is cheap and volatility low

> – Uniswap v4 hooks aim to boost LP returns

> – Why it matters: The debate shapes how decentralized liquidity evolves-and who profits

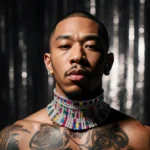

Hayden Adams fired back at critics who argue automated market makers are doomed, insisting the model already dominates in stable, low-cost environments while preparing for major upgrades that could tilt economics back toward liquidity providers.

Adams Responds to AMM Critics

The Uniswap founder posted on X January 6 after trader GEE-yohm “LAMB-bear” Lambert claimed AMMs “can’t ever be sustainable” because fees track realized volatility while LPs sell convexity priced on implied volatility. Lambert argued this gap wipes out months of gains in days.

Adams countered that AMMs outperform in specific niches:

- Stablecoin pairs offer steady yield to participants with cheaper capital, undercutting professional firms

- In long-tail, high-volatility tokens, AMMs scale where order books can’t, with projects and early supporters bootstrapping liquidity

- The toughest arena remains major tokens like ETH pairs, where markouts are scrutinized

> Hayden Adams wrote:

> “AMMs are only just getting started. Lower capital costs and composability give them an edge.”

Upgrades on the Horizon

Uniswap is readying v4 hooks that let builders inject custom logic at the pool level, potentially capturing more value for LPs. Adams said the upgrade arrives as AMM order books have matured for years.

Lambert later softened his stance, calling himself “an AMM maxi” but urging higher fees or tools like Panoptic to hedge gamma risk.

Recent Market Signals

November 2025 delivered a split verdict for AMMs:

- Balancer lost $120 million to a precision-flaw exploit

- UNI jumped 35% after Adams floated a “fee switch” to share revenue with token holders

- Pi Network launched updated DEX and AMM features focused on liquidity organization and user safety

| Event | Impact |

|---|---|

| Balancer exploit | $120M drained |

| UNI fee-switch hint | +35% price spike |

| Pi Network update | New safety-focused AMM tools |

Key Takeaways

- AMMs currently win where volatility is low and capital costs are cheap

- v4 hooks could redefine LP economics this cycle

- Exploits and fee debates show both promise and peril in AMM design

- The consensus: innovate fee structures, don’t abandon the model

The coming v4 release will test whether custom hooks can close the profitability gap and keep decentralized liquidity competitive with professional market makers.