At a Glance

| Highlight | Detail |

|---|---|

| Software | H&R Block tops the 2026 rankings |

| Rules | New tax rules under the One Big Beautiful Bill Act affect 2025 returns |

| Choice | TurboTax remains the most polished choice for complex returns |

Why it matters: Choosing the right software can save time, money, and reduce errors when filing your 2025 tax return.

H&R Block emerges as the best overall choice for filing 2025 returns, thanks to a clear free tier for simple returns and a suite of premium plans that start at $35. TurboTax continues to offer the most comprehensive coverage of filing situations, while FreeTaxUSA remains the cheapest option for those with the simplest paperwork. The One Big Beautiful Bill Act, signed on July 4, 2025, introduces new deductions and benefits that will apply to the 2025 income year, making the choice of software more consequential than ever.

Tax Software Landscape for 2026

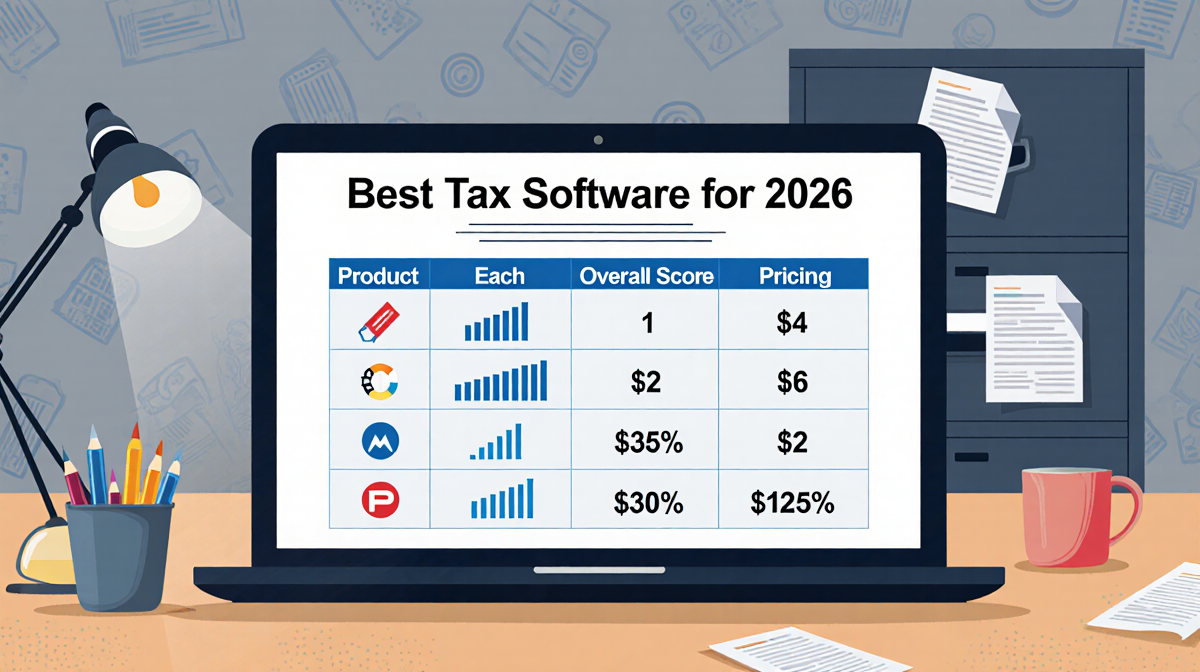

The review evaluated seven major platforms on both mobile and desktop using identical filing scenarios. Each service was scored in five categories-price and affordability, eligibility and use cases, experience and ease of use, features, and expert support. The overall score was an evenly weighted average of these categories. H&R Block earned the highest overall rating of 8.4, followed closely by TurboTax at 8.2 and FreeTaxUSA at 7.2. The scoring framework rewarded transparency, a broad range of use cases, and intuitive interview processes.

Overall Scores

| Product | Overall Score | Pricing |

|---|---|---|

| H&R Block | 8.4 | Free for simple returns; tiered paid plans start at $35 (plus state fees) |

| TurboTax | 8.2 | Free option for simple filers; paid plans start at $0 – $139 (plus state fees) for DIY, up to $150+ for full service |

| FreeTaxUSA | 7.2 | 100% free federal filing; state returns cost $15.99 |

| TaxSlayer | 6.9 | Free for simple filers and active duty military; tiered paid plans start at $22.99 (plus state fees) |

| TaxAct | 6.8 | Free version for simple filers; paid plans start at $29.99 (plus state fees) |

| Cash App Taxes | 5.4 | 100% free federal and state filing |

| Jackson Hewitt Online | 5.4 | $25 flat fee for both federal and state returns |

Key Features Compared

| Feature | H&R Block | TurboTax | FreeTaxUSA | TaxSlayer | TaxAct | Cash App Taxes | Jackson Hewitt Online |

|---|---|---|---|---|---|---|---|

| Free simple returns | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tiered paid plans | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Import W-2 / last year’s return | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ | ✘ |

| Audit defense | ✔ | ✔ | ✘ | ✘ | ✔ | ✘ | ✘ |

| Maximum refund guarantee | ✔ | ✔ | ✘ | ✘ | ✔ | ✘ | ✘ |

| Access to CPA/EA | ✘ | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

New Tax Rules for 2026

The One Big Beautiful Bill Act, signed by President Trump on July 4, 2025, introduced several changes that apply to 2025 income tax returns, which are due April 15, 2026. While the legislation was passed midyear, the new rules affect the tax year that ends in 2025 and the following year.

- Higher standard deductions: The standard deductions for 2025 are $15,750 for single filers, $31,500 for married couples filing jointly, and $23,625 for heads of household. In 2026 these increase to $16,100, $32,200, and $24,150 respectively.

- New deduction for seniors: Seniors 65 and older can claim an additional $6,000 for single filers and $12,000 for married couples.

- No taxes on tips: Through 2028, you can deduct up to $25,000 in tips from taxable income.

- No taxes on overtime: Through 2028, single filers can deduct overtime up to $12,500 of overtime income, married couples filing jointly up to $25,000.

- Car loan interest deduction: Up to $10,000 of interest on qualified cars is deductible if you itemize, with a phase-out starting at $100,000 single and $200,000 married.

- IRS Direct File suspension: The free IRS filing program will not be available in January 2026, when the filing window opens for 2025 returns.

These rules can change the amount of tax you owe or the refund you receive, especially if you have a complex return or qualify for the new senior deduction.

Choosing the Right Software

Selecting a tax-filing platform depends on several factors that vary by taxpayer. The review highlighted five main categories that should guide your decision.

- Complexity of your return – If you have only W-2 income and claim the standard deduction, a free version may suffice. Additions such as dependents, an HSA, or freelance 1099-NEC forms often trigger a paid tier.

- Price and transparency – Look for services that clearly list all costs, including add-ons for audit defense or professional help. Upgrade prompts should be obvious, not hidden.

- Feature set – Robust error-checking, audit defense, and refund guarantees reduce the risk of mistakes. Some software offers an advance on refunds for an additional fee.

- Expert support – For complex returns-business income, crypto sales, or major life changes-consulting a CPA or EA can save hundreds of dollars in penalties and time. Most platforms provide video or screen-sharing options.

- Security – Online filing is preferred by the IRS because it protects personal data. All major software meets strict encryption and identity-verification standards.

### Software Feature Snapshot

| Platform | Free Tier | Paid Tier Start | Audit Defense | CPA/EA Access | Mobile Import |

|---|---|---|---|---|---|

| H&R Block | ✔ | $35 + state fees | ✔ | ✔ (video) | ✔ |

| TurboTax | ✔ | $0 – $139 DIY | ✔ | ✔ (full service) | ✔ |

| FreeTaxUSA | ✔ | $0 | ✘ | ✔ | ✘ |

| TaxSlayer | ✔ | $22.99 | ✘ | ✔ | ✘ |

| TaxAct | ✔ | $29.99 | ✔ | ✔ | ✔ |

| Cash App Taxes | ✔ | ✘ | ✘ | ✘ | ✘ |

| Jackson Hewitt Online | ✘ | $25 flat | ✘ | ✘ | ✘ |

Key Takeaways

- H&R Block leads the 2026 tax-software rankings with an overall score of 8.4, offering a free tier for simple returns and paid plans that begin at $35.

- The One Big Beautiful Bill Act adds new deductions and benefits that will affect the 2025 return, making the choice of software more consequential than ever.

- TurboTax remains the most versatile platform for complex returns, especially when professional help is needed.

- Free filing options often require upgrades for common situations such as dependents or freelance income; transparency in pricing is essential.

- The IRS Direct File program will be unavailable in January 2026, so taxpayers must rely on commercial software for their 2025 returns.

By reviewing the scoring framework and comparing features, taxpayers can choose a platform that balances cost, convenience, and support for their specific filing needs.