At a Glance

- Hyperliquid’s token HYPE jumped 23% in 24 hours, trading near $28.

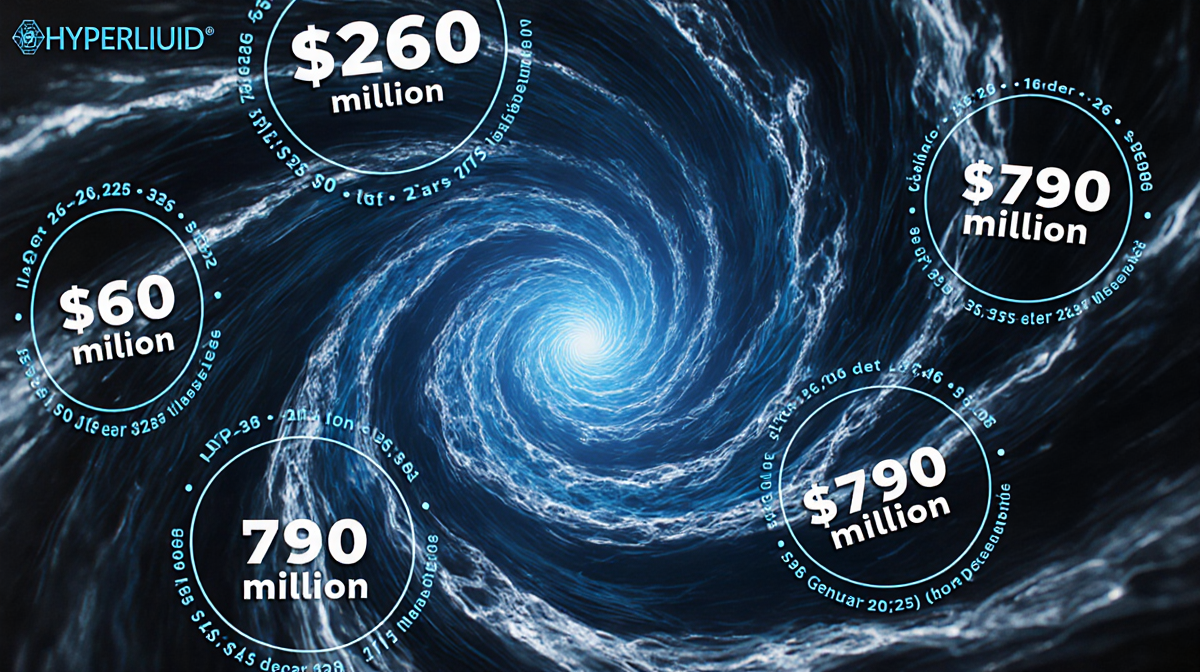

- HIP-3 open interest hit a record $790 million, up from $260 million a month ago.

- Key technical signals-RSI 59, MACD positive, volume 166% higher-suggest a potential trend shift.

- Why it matters: The rally reflects growing institutional interest in Hyperliquid’s new perpetual futures platform and could signal a broader move for crypto-asset markets.

HYPE, the native token of Hyperliquid, has experienced a sharp 23% price increase over the last 24 hours, bringing the token’s value to around $28. The rally follows a surge in activity on the platform’s HIP-3 feature, which allows developers to launch their own perpetual futures markets.

Price Reclaims and Support Levels

After weeks of choppy trading, HYPE fell below the October 10th lows, a level that previously served as support. It has now reclaimed that zone and is trading above it, hovering near $28. The area between $25 and $26 is being watched as a key reclaim zone.

According to Crypto Bully, this zone sets up an “over and under” pattern. The price moved below the level, then quickly recovered it. Holding above this zone could confirm a reversal setup. If it fails to hold, the broader downtrend may resume.

HIP-3 Activity Drives Open Interest

HIP-3, launched in October 2025, has become a major driver of interest on Hyperliquid. Open interest on HIP-3 reached an all-time high of $790 million, according to data shared by Hyperliquid on January 26, 2026. A month earlier, HIP-3 open interest was $260 million.

> “HIP-3 OI has been hitting new ATHs each week. A month ago, HIP-3 OI was $260 million.” – Hyperliquid (@HyperliquidX), January 26, 2026

The rise in open interest tracks with broader interest in commodity-linked markets, which are now tradable on the platform. Market cap for HYPE stands at $6.6 billion, with a circulating supply of 240 million tokens.

HIP-3 Open Interest Timeline

| Date | Open Interest | Comment |

|---|---|---|

| October 2025 | Initial launch | HIP-3 introduced |

| December 2025 | Growing | Weekly ATHs |

| January 26, 2026 | $790 million | All-time high |

| One month ago | $260 million | Baseline |

Technical Indicators Suggest Momentum

The daily RSI is at 59, indicating increasing strength but remaining below overbought levels. The MACD has flipped positive, with the MACD line crossing above the signal line and the histogram turning green. These signals are often watched for early signs of directional change.

| Indicator | Value | Interpretation |

|---|---|---|

| RSI (daily) | 59 | Strengthening but not overbought |

| MACD | Positive | Possible trend shift |

| Volume | 166% higher | Increased activity |

| Open Interest | 29% jump | Growing commitment |

On-Chain Activity and Whale Movements

Recent on-chain activity shows a $10.32 million over-the-counter transfer involving 465,000 HYPE. The transaction moved tokens from Galaxy Digital while buyers defended the $22-$23 zone.

Exchange data from Coinglass shows a 166% increase in volume and a 29% jump in open interest, with total volume at $2.43 billion. Whales continue to remove supply from public markets, reducing immediate selling pressure.

Market Context

The HYPE rally occurs amid broader market volatility. Bitcoin retreated to $90 k while HYPE surged, illustrating divergent movements across crypto assets. Hyperliquid’s platform, known for low-latency trading, is attracting both retail and institutional participants.

Key Takeaways

- HYPE’s 23% rally aligns with a record-high HIP-3 open interest of $790 million.

- Technical indicators (RSI 59, MACD positive) support potential upward momentum.

- Whales are pulling supply from exchanges, easing selling pressure.

- The price action around $25-$26 will be critical for confirming a trend reversal.

Special Offer

SECRET PARTNERSHIP BONUS for News Of Los Angeles readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on News Of Los Angeles is those of writers quoted. It does not represent the opinions of News Of Los Angeles on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.