> At a Glance

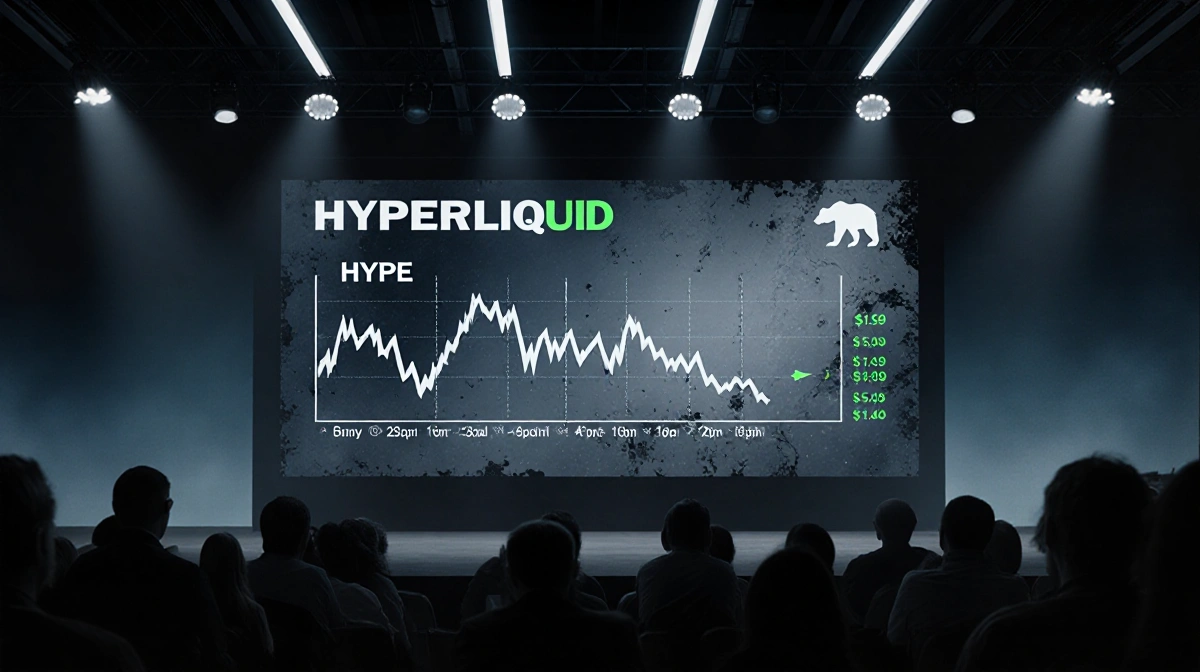

> – Hyperliquid (HYPE) is forming a bear flag near $25.

> – Analysts flag weak momentum and a bearish structure across timeframes.

> – Downside targets sit at $19-$17 if the pattern breaks lower.

> – Why it matters: A break below $24 could accelerate selling, leaving buyers on the sidelines.

Hyperliquid’s native token HYPE is flashing red flags as a bear flag tightens around the $25 level. Sellers remain in control after last week’s liquidity sweep above $28, and chart watchers now eye a possible 20-30% slide.

Bear Flag Pattern Points to $19

Crypto analyst Ali Martinez highlights a textbook bear flag on the 12-hour chart. The pattern follows a sharp drop and channels price through a brief upward drift before the next leg down.

> Ali Martinez noted:

> > “Hyperliquid $HYPE is forming a flag that could result in a move to $19.”

A confirmed close beneath the flag’s lower trendline activates the measured target near $19.

Downside Path and Liquidity Zones

Market observer Hyper_Up maps out the road ahead:

- Internal liquidity rests near $24, a short-term cushion that may slow the fall.

- Worst-case scenario eyes the $17 region if selling accelerates.

- No strong reversal should be expected from the $24 zone.

| Level | Significance |

|---|---|

| $28 | Recently swept, triggering fresh supply |

| $27 | Key resistance; buyers need to reclaim it |

| $24 | Internal liquidity, minor support |

| $19 | Bear-flag measured target |

| $17 | Hyper_Up’s worst-case target |

Momentum Indicators Stay Negative

Short-term gauges remain heavy:

- 9-period EMA is below the 21-period EMA on the 1-hour timeframe.

- Price trades under both EMAs.

- MACD line sits below its signal line with negative histogram bars.

Buyers need a hourly close above $27 to shift the tone.

Key Takeaways

- Bear flag formation targets $19 on a breakdown.

- $24 liquidity may briefly stall declines, but $17 is possible.

- Indicators show persistent selling pressure; reclaiming $27 is crucial for bulls.

With $6 billion in market cap and rank #31, HYPE’s next move could set the tone for the broader DeFi perp-venue sector.