Murphy Oil (MUR) notched a key technical win Wednesday as its Relative Strength Rating vaulted to 83, up from 78 the prior session, placing the energy explorer in the market’s top 20 percent for price momentum.

At a Glance

- Murphy Oil’s RS Rating rose to 83, clearing the 80-plus threshold

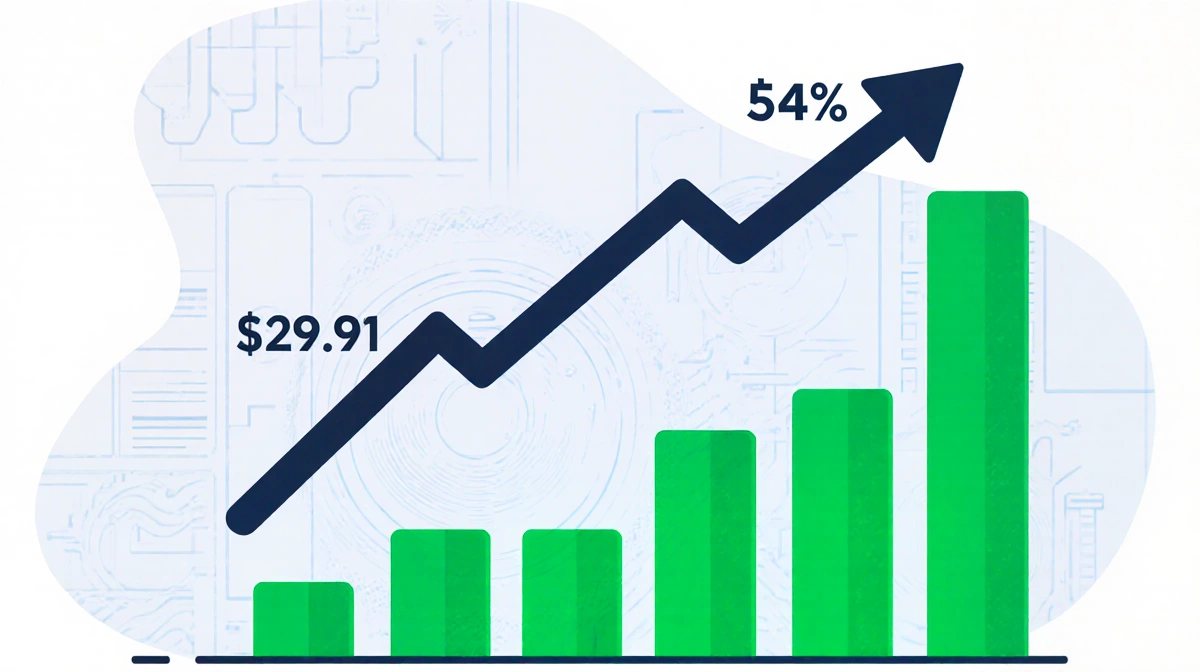

- The stock has now climbed 54% from its October 2023 low

- Wednesday’s move marks the strongest momentum rank since early 2022

- Why it matters: A rating above 80 often draws algorithmic and growth-oriented funds that chase outperformers

The upgrade lands as crude prices stabilize above $80 a barrel and the offshore driller posts back-to-beats on both production and cash-flow guidance.

RS Rating Explained

IBD’s RS Rating gauges a stock’s 12-month price performance against all other publicly traded names. The scale runs from 1 (worst) to 99 (best). Scores at or above 80 indicate the equity is outpacing at least four-fifths of the market.

Key components:

- 12-month price change versus the S&P 500

- Near-term momentum (most recent quarter weighted heavier)

- Volatility adjustments to smooth sharp one-day spikes

Murphy’s latest reading of 83 means only 17 percent of U.S.-listed stocks have posted stronger returns over the past year.

Price Action in Context

Shares closed Wednesday at $46.12, up 2.4 percent on volume 18 percent above the 50-day average. The move extended a rally that has lifted the stock 54 percent from its October 2023 low of $29.91.

| Milestone | Date | Price | RS Rating |

|---|---|---|---|

| 2023 low | Oct 27, 2023 | $29.91 | 38 |

| First close above 200-day | Dec 15, 2023 | $35.40 | 56 |

| Breakout pivot | Feb 5, 2024 | $41.20 | 71 |

| Latest close | May 8, 2024 | $46.12 | 83 |

The advance has trounced the Energy Select Sector SPDR, which is up 11 percent over the same span, and the S&P 500’s 14 percent gain.

What’s Driving Momentum

Murphy has topped quarterly earnings estimates in three straight reports while raising its offshore production forecast for the Gulf of Mexico. Executives on the most recent call guided to 195,000 barrels of oil equivalent per day for 2024, up from prior guidance of 190,000.

Additional tailwinds:

- Hedged 60% of 2024 output at $83 Brent, locking in cash-flow visibility

- Net-debt-to-EBITDAX ratio fell to 0.7×, the lowest since 2018

- Initiated a $300 million share-repurchase program in March

- Sabiri field startup in Malaysia slated for Q4, adding 15,000 boepd

Portfolio managers note that the combination of rising oil prices and capital-discipline metrics has lured both value and momentum buyers. “Energy names with balance-sheet flexibility are back in favor,” said News Of Los Angeles‘s energy sector analyst.

Technical Levels to Watch

With the RS surge, Murphy is flashing multiple bullish signals on its weekly chart:

- Relative strength line (not RS Rating) hitting new highs ahead of price

- Stock trading above rising 10-week and 40-week moving averages

- Accumulation/Distribution Rating upgraded to B+ last week

Immediate resistance sits at the $48.50 high from November 2022; clearing that opens a path toward the $52 level, last touched in June 2022. Support is anchored at the 10-week line around $42.

Capital Return Outlook

Management reiterated its goal of returning at least 40 percent of free cash flow to shareholders this year via buybacks and the base dividend yielding 2.3 percent. At current strip pricing, that implies roughly $450 million in total distributions, equating to a 6 percent shareholder yield.

Buyback cadence:

- $75 million repurchased in Q1 at an average $41 per share

- Remaining authorization of $225 million through 2025

- Management prefers buybacks when shares trade below 8× forward EBITDA

The stock currently changes hands at 7.2× 2024 estimated EBITDA versus a 10-year median of 6.5×.

Risks on the Radar

Despite the upbeat momentum, investors face several wildcards:

- Offshore outages: Murphy’s high-margin Gulf assets are vulnerable to hurricane season

- Oil-price volatility: Each $5 Brent move swings annual free cash flow by ~$150 million

- Regulatory overhang: U.S. Department of Interior has paused new Gulf leases pending environmental review

- Execution risk: Sabiri start-up involves subsea tie-backs with a history of delays across the industry

Analysts at News Of Los Angeles maintain a buy rating with a $52 price target, citing the firm’s improved cost structure and leverage profile. They flag that any re-test of $80 Brent would likely push free-cash-flow yields above 15 percent, well above the sector median.

Key Takeaways

- Murphy Oil’s RS Rating of 83 places it among the market’s top quintile for momentum

- Shares have rallied 54 percent since October, outpacing both energy peers and the broader market

- Strong production guidance, balance-sheet improvements and capital returns underpin the advance

- Next technical hurdle is $48.50; a breakout could extend the run toward $52