> At a Glance

> – The Senate could vote on the CLARITY Act as early as January 15

> – Bipartisan effort led by Senators Lummis and Scott

> – Bill would shift Bitcoin and Ether to CFTC oversight

> – Why it matters: New rules could end years of regulatory uncertainty for crypto investors and developers

A long-awaited overhaul of U.S. crypto regulation is inching toward a Senate floor vote. The CLARITY Act, championed by Senator Cynthia Lummis, would strip the SEC of sweeping crypto authority and hand day-to-day oversight of major tokens to the Commodity Futures Trading Commission.

Bill Clears Key Hurdles

Senate Banking Committee Chair Tim Scott said the draft “will advance to Senate deliberations imminently.” A January 15 markup is locked in to merge competing versions from the Banking and Agriculture panels.

Senator Lummis hailed progress made since the FTX collapse, Fed hostility, and SAB-121 veto:

> “We are close to a bipartisan legislation that will stand the test of time.”

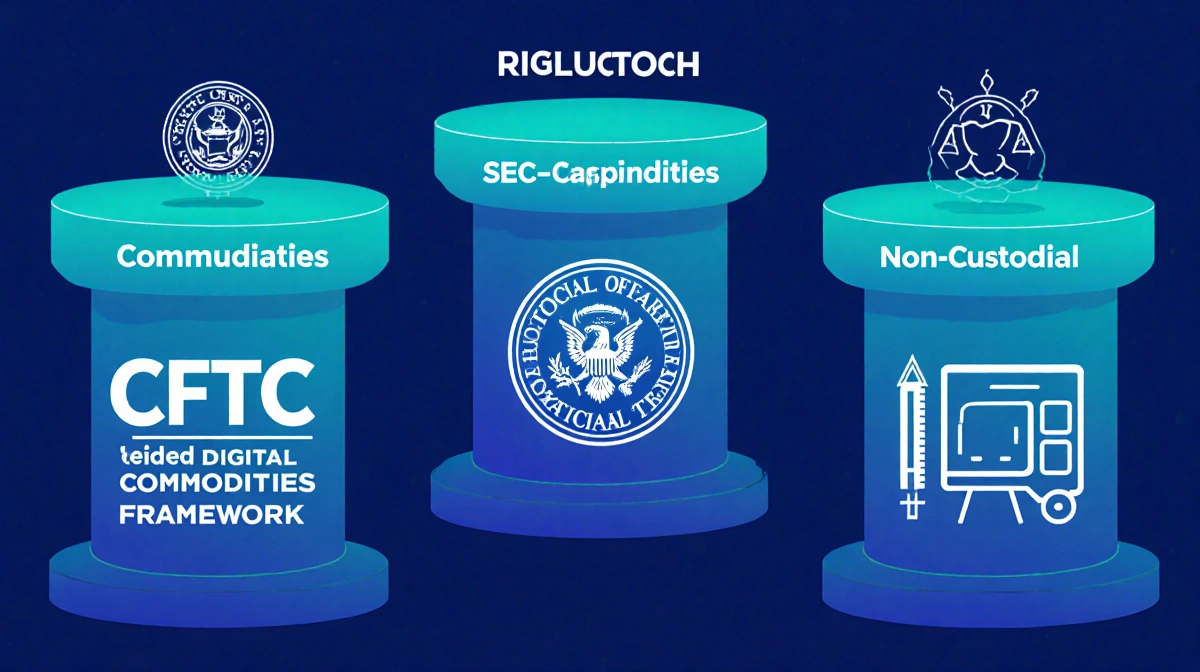

What the Act Actually Does

- Defines Bitcoin, Ether, and similar tokens as commodities, not securities

- Shrinks SEC jurisdiction to genuine securities only

- Creates a CFTC-led digital-commodities framework

- Protects developers building non-custodial tools

- Tightens retail-market supervision and aligns global rules

Timeline and Odds

Prediction-market data from Kalshi shows the bill’s passage chances:

| By Date | Probability |

|---|---|

| April 2026 | 20% |

| May 2026 | 47% |

| End of 2026 | 74% |

Bitwise CIO Matt Hougan warned that without legislation, the current pro-crypto tilt at agencies could reverse after the next election:

> “I’m cautiously optimistic.”

Political Roadblocks Ahead

TD Cowen analysts caution final approval may slip to 2027, with implementation not before 2029. Democrats have little incentive to speed things up, especially if the House flips after the 2026 midterms.

Key Takeaways

- January 15 is the next critical date for crypto legislation

- The bill would move Bitcoin and Ether regulation from SEC to CFTC

- Odds favor passage by year-end, but political delays could push enactment to 2029

- Developer protections for non-custodial software are included

A successful vote would mark the biggest shift in U.S. crypto policy since the industry’s birth.