At a Glance

- The IRS introduces a dedicated crypto tax form, 1099-DA, for the 2025 tax year.

- Transactions on or after Jan. 1, 2025 must be reported on this form, replacing the old 1099-B.

- Brokers must include cost basis starting in 2026, and taxpayers must keep accurate records to avoid penalties.

Why it matters:

Crypto traders will need to adjust their record-keeping and reporting processes to comply with the new form and avoid under-reporting or over-taxation.

The IRS has announced a new tax form that will change how cryptocurrency transactions are reported for the 2025 tax year. The dedicated form, called 1099-DA, replaces the older 1099-B that was used for securities. All digital-asset proceeds from broker transactions made on or after Jan. 1 2025 must now be reported on this form, and brokers are required to include cost basis starting in 2026. Even if the form is not sent automatically, taxpayers must still file the information correctly on their returns.

—

New Form and What It Means

The IRS created the 1099-DA to improve compliance and visibility in the digital-asset ecosystem. The form is mandatory for any transaction involving crypto or other digital assets during the 2025 tax year. The form will arrive in early 2026, but taxpayers are responsible for filing their taxes regardless of whether they receive it.

Mark Steber, chief tax officer at Jackson Hewitt, explained that many people mistakenly think that not receiving a 1099-DA means they can ignore crypto earnings. “One of the biggest misconceptions from taxpayers is that if they don’t receive a 1099-DA form that they don’t have to report their crypto earnings on their tax return,” said Mark Steber, chief tax officer at Jackson Hewitt.

—

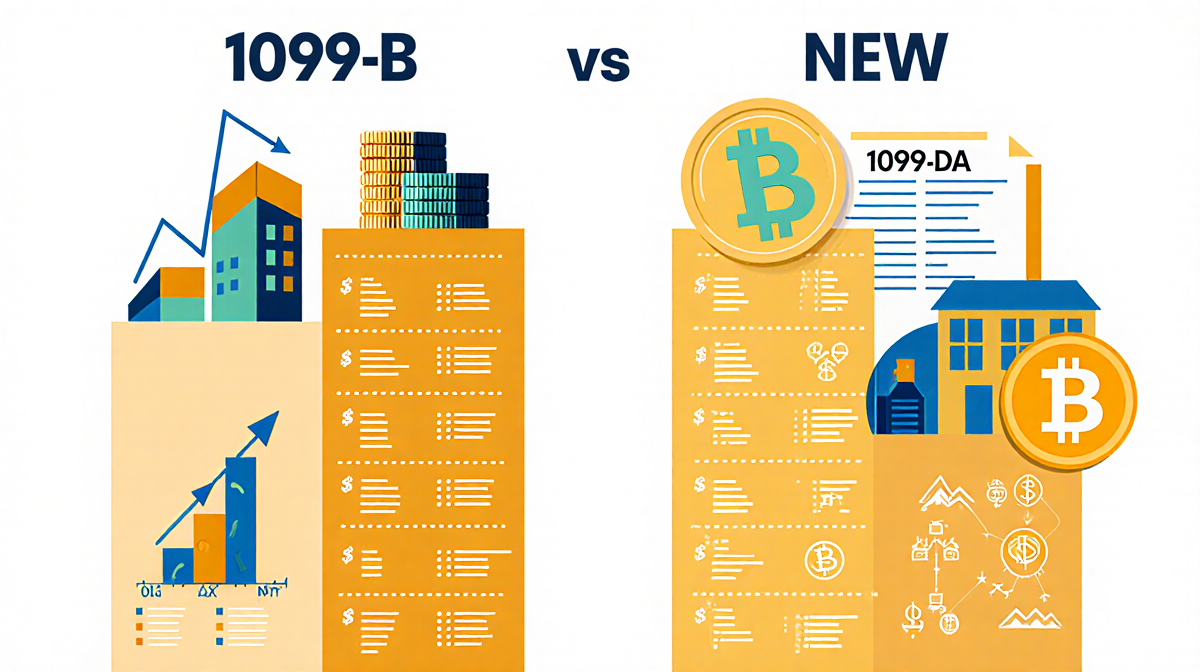

Key Differences Between 1099-B and 1099-DA

| Feature | 1099-B (old) | 1099-DA (new) |

|---|---|---|

| Asset type | Stocks, bonds, mutual funds | All digital assets (NFTs, cryptocurrency) |

| Asset code | Ticker symbol | Digital Token Identifier (DTI) |

| Wallet transfers | Generally non-applicable | New box (12b) for transfer-in date |

| Gross proceeds | Required | Required |

| Cost basis | Optional for 2025 | Optional for 2025; required for 2026 |

The 1099-DA adds a box for the transfer-in date and requires brokers to report gross proceeds for every sale or exchange. Cost basis is optional for 2025 but will become mandatory for all trades starting in 2026.

—

Who Is Considered a Broker?

The IRS defines a broker as any entity that “takes possession of the digital assets being sold by their customers.” The following entities will send a 1099-DA:

- Centralized exchanges (e.g., Coinbase, Kraken, Gemini)

- Payment processors that use crypto for payments (e.g., PayPal, Venmo)

- Hosted wallets that hold private keys

- Real-estate entities that accept crypto for property purchases in 2025

- Non-custodial middlemen (e.g., DeFi participants and crypto wallets not controlled by exchanges) may not have to report until 2027, but the taxpayer must still report any income.

Lisa Greene-Lewis, CPA and TurboTax spokesperson, added that “You will be required to report DeFi activities like staking rewards on your taxes.” She noted that staking rewards, liquidity pool tokens, and airdrops are normally reported as ordinary income when first received and should be entered as “Other” income.

—

Compliance and Penalties

If a taxpayer’s records do not match what the broker reports, the IRS can impose fines even for honest mistakes. Because the 1099-DA is new, brokers are given some leeway:

- Brokers who file in good faith and submit forms on time will not face penalties.

- Taxpayers must still report all digital-asset income, even if no form is received.

Key dates to remember:

- Dec. 31, 2025: Final day for crypto transactions to be included in the 2025 tax year.

- Jan. 1 2026: Cost basis must be listed on the 1099-DA for any transaction on or after this date.

- Feb. 17 2026: Brokers must provide a receipt showing the 1099-DA information they reported to the IRS.

- Mar. 31 2026: Deadline for brokers to e-file 1099 forms with the IRS.

Andy Phillips, vice president of the Tax Institute at H&R Block, advises that if a broker’s 1099-DA appears incorrect, the taxpayer should contact the broker immediately. “If the issue relates to inaccurate cost basis or gross proceeds, and the broker will not correct the issue, the investor should report the transaction accurately on their tax return,” he said. “However, it is vital they maintain records to validate their reported values as the IRS may note the discrepancy in processing.”

—

Managing Your Crypto Tax Reporting

Like stocks, digital-assets fluctuate in price. Each purchase or sale is treated as a “lot.” The Department of the Treasury and the IRS now default to a “first-in, first-out” (FIFO) lot-selection method. This means the cost basis and gross proceeds for a lot are matched together in the order the assets were acquired. If a taxpayer wants a different lot selection, they must notify the broker at the time of sale. Major exchanges allow setting this preference in the account.

Because the new form may omit cost basis for 2025, a taxpayer could be taxed on the full gross proceeds if the cost basis is blank. For example, if a 1099-DA shows $10,000 in gross proceeds but leaves the cost basis empty, the IRS may treat the cost as $0, leading to taxation on the entire amount. Record-keeping is therefore essential to prove the correct cost basis and reduce the tax bill.

Most self-service tax software now supports crypto reporting. TurboTax and H&R Block are recommended for complex situations. They can import 1099-DA data and help users enter cost basis and lot information accurately.

—

Key Takeaways

- The IRS has introduced the 1099-DA for 2025, replacing the 1099-B for crypto transactions.

- Brokers must report gross proceeds and will include cost basis starting in 2026.

- Taxpayers must keep detailed records and report all income, even if no form is received.

- The new default lot-selection is FIFO; taxpayers can request alternatives.

- Missing or incorrect cost basis can lead to over-taxation, so accurate record-keeping is critical.