At a Glance

- President Trump set a January 20 deadline for credit card companies to cap interest rates at 10%

- The White House has not specified penalties for non-compliance, leaving industry leaders uncertain

- Americans could save $100 billion annually in interest under the proposed cap

- Why it matters: Credit card debt affects millions of Americans, and the outcome could reshape lending practices nationwide

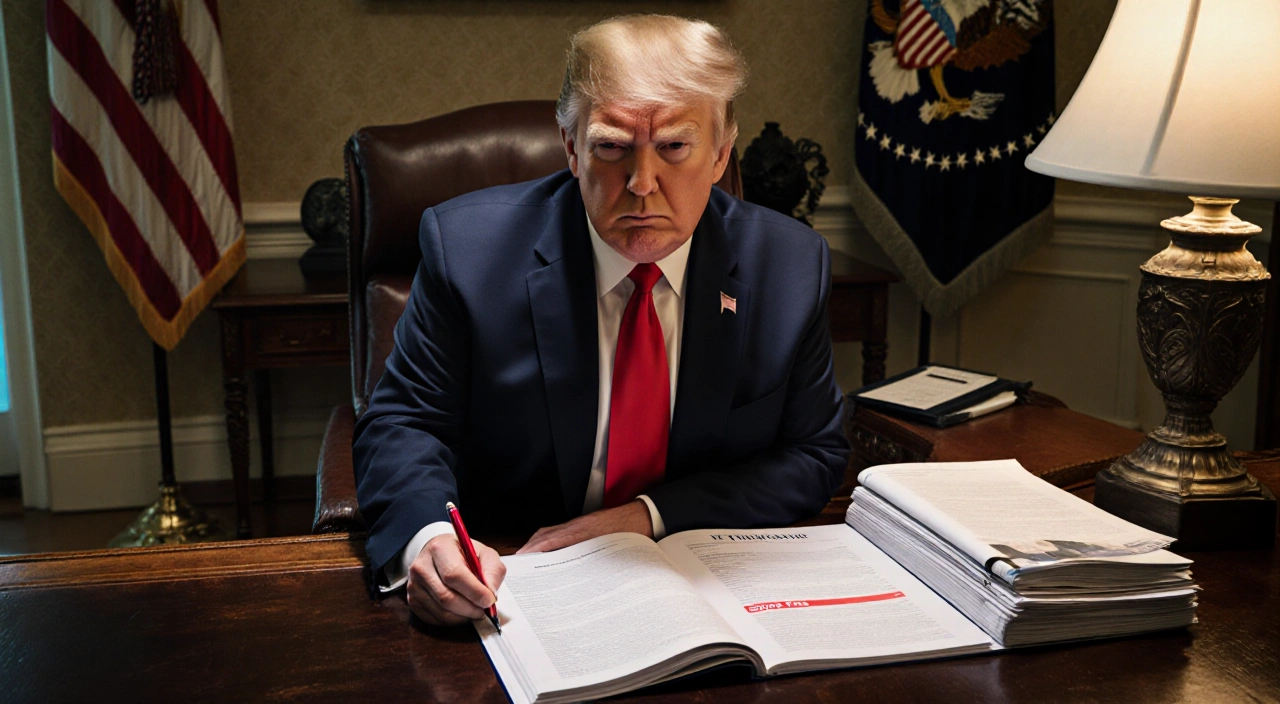

President Donald Trump issued a direct demand to the credit card industry last week: cap interest rates at 10% by January 20. With the deadline days away, consumer advocates, politicians, and banking executives alike remain uncertain about the White House’s next steps or whether the president intends to enforce the policy.

White House Offers No Enforcement Plan

White House Press Secretary Karoline Leavitt confirmed the president’s stance but offered no specifics on consequences for non-compliance.

“I don’t have a specific consequence to outline for you but certainly this is an expectation and frankly a demand that the president has made,” Leavitt said on Friday.

The administration has amplified research showing that a 10% cap could save Americans $100 billion annually in interest payments. That research, conducted during the 2024 campaign, also found that while the credit card industry would face significant losses, it would remain profitable-though rewards programs and perks might shrink. The White House shared the findings on an official Twitter account.

Industry Lobbyists Left Scrambling

Bank lobbyists have spent the past week attempting to determine the administration’s next move, but sources told News Of Los Angeles they have received little clarity.

Despite bipartisan interest in credit card reform, Republican leadership in both chambers of Congress has shown little appetite for legislating interest rate caps. The Dodd-Frank Act, enacted after the 2008 financial crisis, explicitly bars at least one federal bank regulator from setting usury limits on loans.

Without legislative or executive action, the president may rely on political pressure-an approach he has used successfully in other sectors.

Trump’s Track Record of Industry Pressure

Trump previously pressured pharmaceutical companies to lower drug prices, prompting some CEOs to pledge compliance. He also demanded that tech and chip manufacturers shift production to the U.S., leading companies like Apple to commit to domestic expansion.

Wall Street has little incentive to confront the administration directly. Banks have benefited from the Trump administration’s deregulatory agenda, including the One Big Beautiful Bill signed in July, which delivered another round of tax cuts. Deregulation also encouraged dealmaking, generating steady investment banking revenue for major institutions.

Banks Push Back-But Offer to Cooperate

Banking executives and trade groups have adopted a two-pronged strategy: resisting the cap publicly while signaling openness to dialogue.

On a Tuesday call with reporters, JPMorgan CFO Jeffrey Barnum indicated the industry would use all available resources to oppose the administration’s plan. JPMorgan holds $239.4 billion in credit card balances and maintains major partnerships with United Airlines and Amazon. The bank also recently acquired the Apple Card portfolio from Goldman Sachs.

**Citigroup CFO Mark Mason echoed the sentiment on Wednesday, stating a cap “is not something we could or would support,” arguing it would restrict consumer credit and harm the economy. Still, he added, “Affordability is a big issue, and we look forward to collaborating with the administration on ways we can address this.”

Trump Backs Bill Targeting Swipe Fees

In a related move, Trump endorsed a congressional bill that could reduce the fees banks collect from merchants each time a customer uses a credit card.

One Company Moves First

Not all firms are waiting for federal action. Fintech company Bilt launched a new credit card line this week, capping interest rates at 10% on new purchases for one year. While promotional rates are common in the industry, Bilt’s move could serve as a model for complying with the administration’s demands without overhauling business models.

“If (a credit card rate cap) is going to happen, we’d rather be at the forefront,” said Ankur Jain, Bilt’s CEO.

Key Takeaways

- The January 20 deadline is days away with no enforcement mechanism revealed

- Americans stand to save $100 billion** annually if the cap takes effect

- Major banks oppose the move but are reluctant to escalate tensions

- One fintech firm has already adopted the cap as a promotional strategy

- The administration may rely on pressure tactics rather than legislation to push the policy forward