At a Glance

- Donald Trump canceled $0 of tariffs scheduled for February 1.

- Bitcoin whipsawed between $87,000 and $90,000 in hours.

- $1 billion in crypto positions liquidated, up 40% in 24 h.

- Why it matters: Traders face massive volatility as political headlines override technical levels.

President Donald Trump stunned traders by scrapping impending tariffs tied to Greenland, igniting wild swings across digital-asset markets.

The move, announced on Truth Social, cited “a very productive meeting” with NATO Secretary General Mark Rutte and the outline of a future Arctic deal. “This solution, if consummated, will be a great one for the United States of America, and all NATO Nations,” the post read. “Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st.”

Markets had already sold off on tariff fears; the sudden reversal sent risk assets on a roller-coaster ride.

Bitcoin’s $3,000 Round Trip

- Price dove to $87,000 within minutes of the announcement.

- Buyers stepped in, pushing BTC back to $90,000.

- The round trip unfolded in under three hours.

According to News Of Los Angeles‘s data desk, the choppy action triggered forced liquidations worth $1 billion, a 40% jump from the prior day. Longs and shorts alike were caught in the crossfire as leverage levels remained elevated ahead of the tariff deadline.

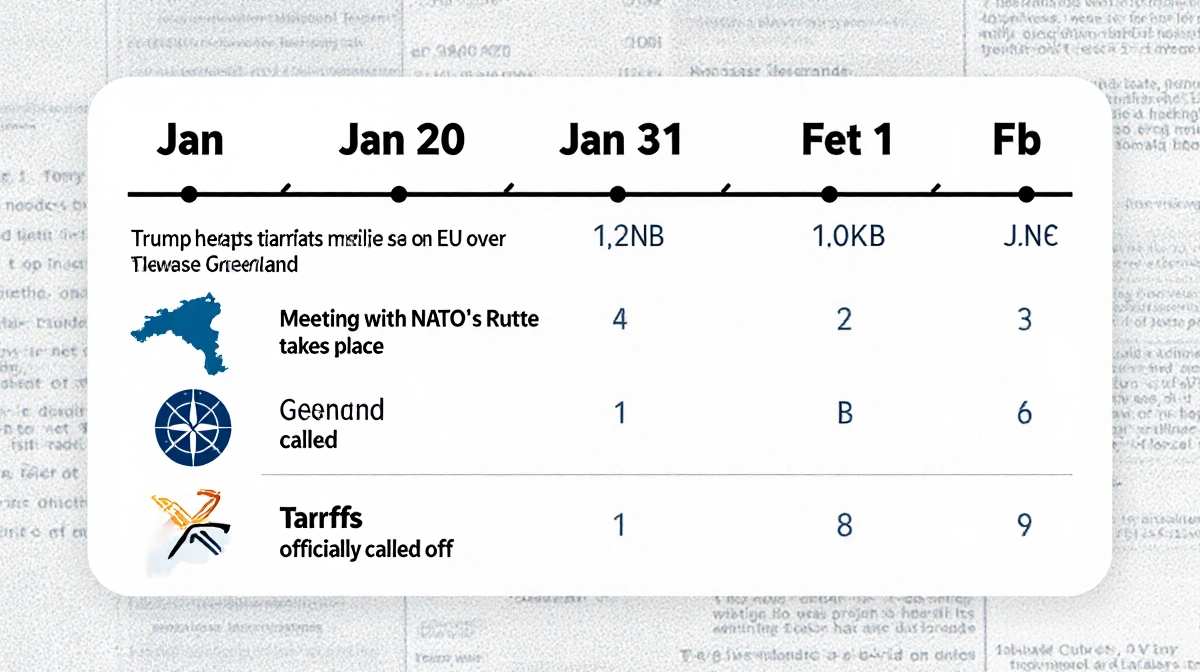

Tariff Timeline

| Date | Event |

|---|---|

| Jan 30 | Trump threatens tariffs on EU over Greenland |

| Jan 31 | Meeting with NATO’s Rutte takes place |

| Feb 1 (a.m.) | Tariffs officially called off |

The speed of the policy U-turn left little time for market makers to adjust spreads, amplifying price swings.

Liquidation Breakdown

- $1 billion total liquidated positions

- 40% surge in liquidations vs. 24 h earlier

- Long squeezes dominated the first hour; shorts followed on the rebound

Jonathan P. Miller noted that open interest had climbed ahead of the deadline, magnifying the cascade once volatility spiked.

Key Takeaways

- Political headlines, not macro data, are driving intraday moves.

- Leveraged traders face outsized risk when policy shifts without warning.

- Bitcoin’s correlation with broader risk sentiment remains high, despite narratives of digital gold.

Markets now await the next development in the Greenland saga, with Trump hinting that a formal Arctic agreement could still emerge. Until then, volatility is likely to stay elevated as traders price in the possibility of fresh tariff threats at any moment.