At a Glance

- Your 2025 W-2 form must arrive by Feb 2, 2026 because Jan 31 lands on a Saturday

- The document shows every dollar you earned and every tax dollar withheld last year

- Missing or incorrect data triggers refund delays and IRS notices

- Why it matters: Without an accurate W-2 you cannot file, costing you time, money, and peace of mind

The first week of February is W-2 season for more than 160 million US workers. Employers must deliver the form that tells the IRS-and you-exactly how much you were paid and how much tax was pulled from your checks in 2025. Daniel J. Whitman reported for News Of Losangeles that the standard Jan 31 deadline shifts to Feb 2 this cycle, so a slight postal lag is normal.

What a W-2 Actually Is

A W-2, formally the Wage and Tax Statement, is the official record of:

- Gross wages, tips and other compensation

- Federal, state and local income tax withheld

- Social Security and Medicare tax withheld

- Retirement-plan contributions such as 401(k) deferrals

- Health savings account contributions

- Allocated tips for hospitality workers

You will reference every one of those numbers when you complete your 2025 return, whether you file on paper, through software or with a tax pro. Employers must send a separate W-2 for each job you held, and they must also forward copies to the Social Security Administration.

When and How Your W-2 Arrives

Calendar note: Monday, Jan 26, 2026 marks the official start of tax-filing season. By law your employer has until Feb 2 to put the form in your hands-mailed, e-mailed or posted to an employee portal. Keep the original; the IRS can ask for it years later.

If you consented to electronic delivery, check your payroll site first. Otherwise, watch the mailbox. A few days’ delay past Feb 2 is not unusual, but if nothing shows by mid-month, contact payroll and the IRS.

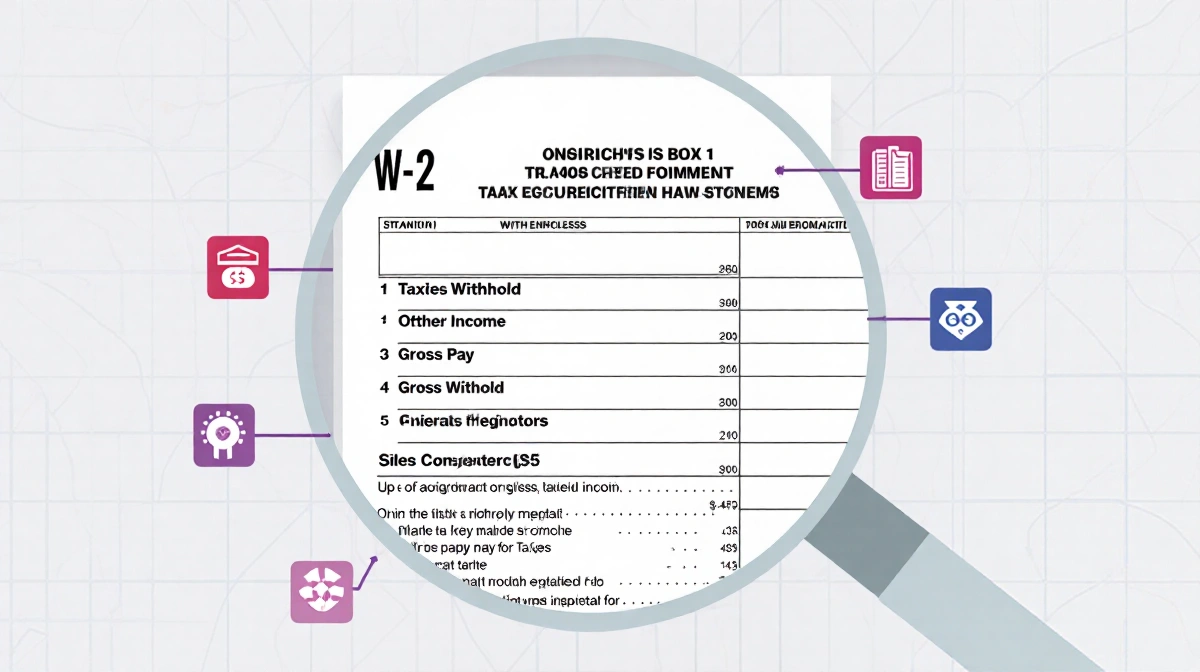

How to Read Every Box

The W-2 looks busy, but each section has a single purpose.

Employee and Employer IDs

- Boxes a-f list your Social Security number, legal name, address, employer name and the firm’s unique federal employer identification number

- Verify the Social Security number; a mismatch freezes refunds

Wage and Federal Tax Data

- Box 1 total taxable wages

- Box 2 federal income tax withheld

- Box 3 Social Security wages

- Box 4 Social Security tax withheld

- Box 5 Medicare wages and tips

- Box 6 Medicare tax withheld

Boxes 7-8 cover tip income if you work in hospitality.

Deductions and Special Benefits

- Box 10 dependent-care benefits

- Box 11 deferred compensation

- Box 12 up to 28 letter-coded items-D for 401(k), E for 403(b), W for employer HSA funding, AA for Roth 401(k) and more

- Box 13 three check-boxes: retirement-plan participation, third-party sick pay, statutory employee status

- Box 14 union dues, state disability insurance, tuition assistance or other local data

State and Local Tax Lines

- Box 15 employer state ID

- Box 16 state-taxable wages

- Box 17 state income tax withheld

- Box 18 local wages

- Box 19 local tax withheld

- Box 20 city or county name

Common Errors to Catch

Compare every figure with your final 2025 paystub. Typical red flags:

- Box 1 earnings that do not match year-to-date gross minus pre-tax deductions

- Missing 401(k) or HSA amounts in Box 12

- Zero federal withholding when you elected tax to be taken

- Wrong state if you moved mid-year

One typo can change your refund by hundreds of dollars and draw IRS correspondence.

What If the Form Is Wrong?

Ask payroll for a corrected W-2, called a W-2c. Do not file your return using bad numbers. The IRS receives the same data and will cross-check. If the employer will not cooperate, call the IRS at 800-829-1040 and file Form 4852, a substitute wage statement, using paystub numbers.

Lost or Missing W-2 Strategy

- Contact payroll first; many systems let you re-download

- If the company shut down, call the IRS after Feb 23; have your last paystub ready

- Still file by April 15 even without the form-use Form 4852 and amend later if numbers change

Digital Storage Tips

Save a PDF on your computer and a backup in cloud storage. The IRS can audit returns for three years, six if you under-state income by more than 25 percent. A faded ink copy can be rejected, so keep digital versions secure and readable.

Key Takeaways

- Your 2025 W-2 must arrive by Feb 2, 2026; check mail and payroll portals

- Match every box to your final paystub before filing

- Request a corrected form immediately if you spot errors

- File on time even if you must estimate with Form 4852; amend later if needed

Follow those steps and the form that once looked like alphabet soup becomes the key that unlocks a smooth, surprise-free tax season.