At a Glance

- World Liberty Financial (WLFI) surged 16% in 24 hours, climbing to nearly $0.18.

- Bitcoin reclaimed $91,000 for the first time since mid-December.

- Impeachment odds on Polymarket actually fell 3% since the military action began.

- Why it matters: Crypto tokens tied to the U.S. president are moving opposite to political prediction markets, creating a volatile trading environment.

Crypto markets awoke to a geopolitical shock after the U.S. military struck Caracas and detained Venezuelan leader Nicolás Maduro. Tokens branded with the president’s name reacted fastest.

Price Action in Focus

WLFI led the charge, vaulting 16% within a day to trade around $0.18. The rally pushed TRUMP back into the top 100 altcoins with a 7.5% gain to $5.40, while BTC punched above $91,000 for the first time since mid-December.

Price snapshots:

- WLFI: $0.155 → $0.18 (+16%)

- TRUMP: $5.02 → $5.40 (+7.5%)

- BTC: $90,000 → $91,000+ (+1.1%)

Political Fallout vs. Prediction Markets

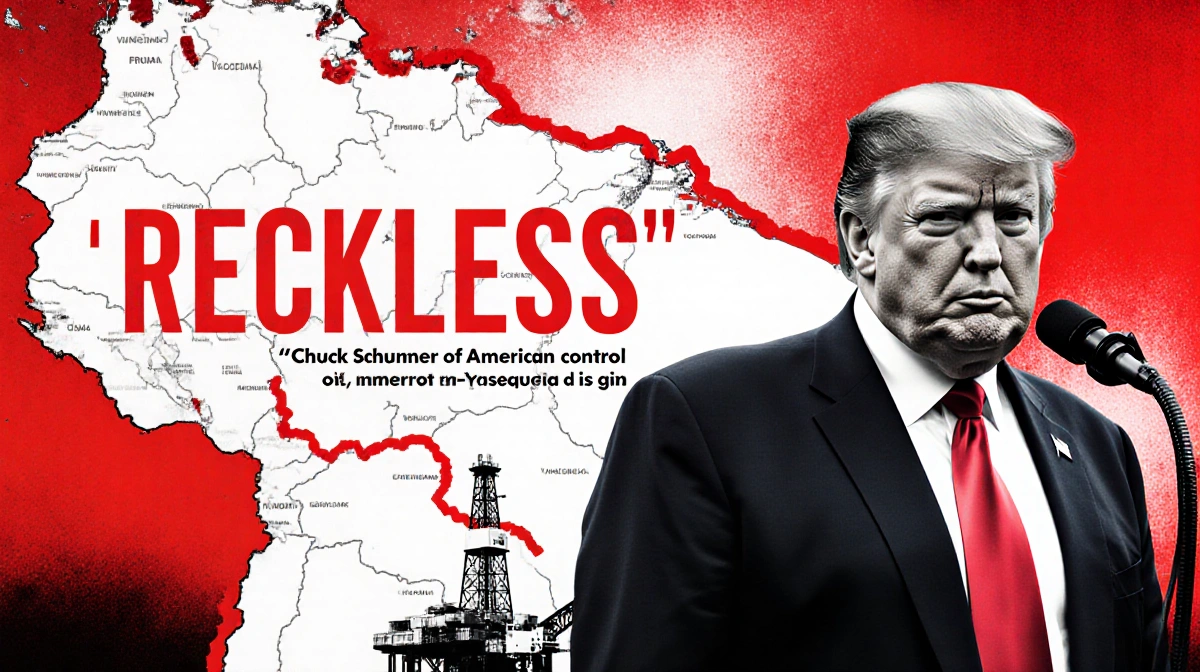

President Trump told the nation he bypassed Congress to prevent leaks, vowing that the U.S. will now oversee Venezuela’s $17 trillion oil reserves. Senate Leader Chuck Schumer called the operation “reckless,” warning that American control of Venezuelan oil “should strike fear in the hearts of all Americans.”

Despite the uproar, impeachment odds on prediction sites moved counter to expectations:

| Market | Impeachment by Dec 31, 2026 | Change Since Strike |

|---|---|---|

| Polymarket | 17% | -3 pts |

| Kalshi | 19% | -2 pts |

| Kalshi (by Jan 1, 2027) | 22% | -1 pt |

Key Takeaways

- President-linked tokens outperformed major crypto assets after the Venezuela operation.

- Prediction-market traders lowered impeachment odds, not raised them.

- Bitcoin’s break above $91,000 adds momentum to the risk-on mood across digital assets.

With WLFI and TRUMP surging while impeachment probabilities slide, crypto traders are pricing in a very different political risk outlook than conventional betting markets.