At a Glance

- XRP plunged to $1.84 on Monday, its lowest since January 2

- The token has dropped 23% from its January 6 high of $2.41

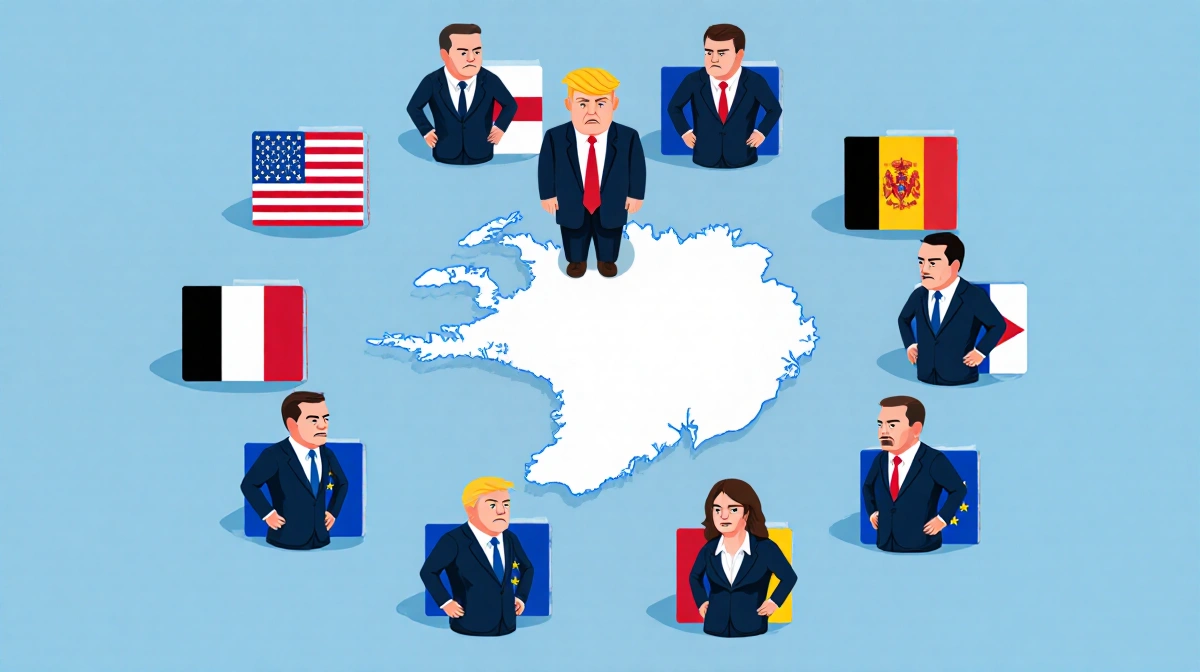

- Eight EU nations sent troops to Greenland after Trump renewed purchase talk

- Why it matters: XRP now trades at the exact $1.975 support level analysts say it must hold

Ripple’s native token XRP has tumbled below the psychological $2 level for the first time in over two weeks, dragged down by a sudden escalation in global trade tensions that caught the broader crypto market off guard.

Monday Meltdown Erases Year-to-Date Gains

The cross-border payments token opened the week by sliding to $1.84, its weakest print since January 2, before trimming losses to around $1.97 at press time. The 24-hour slide has extended XRP’s drawdown from its January 6 peak of $2.41 to more than 23%, according to TradingView data.

Bitcoin’s own rout-from above $95,000 to under $92,000-amplified selling pressure across the altcoin universe, but XRP’s decline outpaced most large-cap peers. The token now trades at the precise $1.975 inflection point that analyst CryptoWZRD flagged as critical for maintaining upside momentum.

Greenland Row Sparks Tariff Threats

The selloff coincided with a rapid-fire escalation between Washington and Brussels over Greenland. Eight European Union countries dispatched military personnel to the island for what officials described as a reconnaissance mission after U.S. President Donald Trump reiterated his desire to purchase the territory.

In response, the White House announced fresh tariffs targeting the nations that contributed troops. EU leaders convened an emergency session, with French President Emmanuel Macron urging the bloc to deploy its unused “trade bazooka”-a powerful economic tool that has never been activated.

Crypto markets remained largely flat over the weekend when the geopolitical developments first surfaced. Selling accelerated only on Monday morning when Asian cash equities and U.S. futures reopened.

Technical Picture Hangs by a Thread

CryptoWZRD noted that XRP closed the daily candle bearish against both the dollar and Bitcoin, reflecting the broader risk-off tone. In a post on X, the analyst wrote:

> “XRP needs to hold above $1.9750 to gain further upside momentum.”

The token currently hovers fractions of a cent below that threshold, leaving its near-term trajectory finely balanced. A decisive break lower could open the door to deeper technical support around $1.80, while a bounce would face initial resistance near $2.05.

Broader Altcoin Pain

While Bitcoin recovered modestly from its intraday low, most alternative cryptocurrencies remain in the red. The risk-sensitive environment has reversed a nascent uptrend that had carried XRP to its highest level since 2018 just two weeks ago.

Monday’s rout has also widened the market-cap gap between XRP and BNB, the third-largest cryptocurrency. Ripple’s token now trails the Binance-native coin by several billion dollars, according to News Of Los Angeles‘s internal data.

Key Takeaways

- XRP’s 23% retreat from its January high has pushed prices below the psychologically important $2 mark

- Geopolitical headlines-U.S. tariff threats against EU nations over Greenland-triggered the latest leg lower

- The token now sits at the $1.975 support level that analysts view as pivotal for continued recovery

- Failure to reclaim that floor could expose a move toward $1.80, while regaining $2.05 would signal stabilization