At a Glance

- XRP trading near $1.89 after pulling back from $2.40.

- The $1.97 level is a key resistance; a breakout could shift the short-term structure.

- Whale activity: 130 million tokens moved to exchanges, Binance balance up to 2.74 billion.

- Why it matters: Market participants are watching for a breakout or rejection that will set XRP’s next direction.

XRP is hovering close to $1.89 as it tests a descending trendline that has turned into resistance. After a pullback from early-January highs of $2.40, traders are focused on whether the token will break above $1.97 or resume its decline.

Price Tests Key Resistance

At press time, XRP is trading around $1.89 and is testing a descending trendline that had acted as support before the recent breakdown. This trendline, now turned resistance, aligns with the $1.97 level. A move above this area may shift the short-term structure, opening the door for further upside.

More Crypto Online noted that the current bounce has brought XRP back to this technical zone. If the price pushes through and holds above $1.97, the correction may “become far more complex.” A rejection at this level would support a bearish outlook.

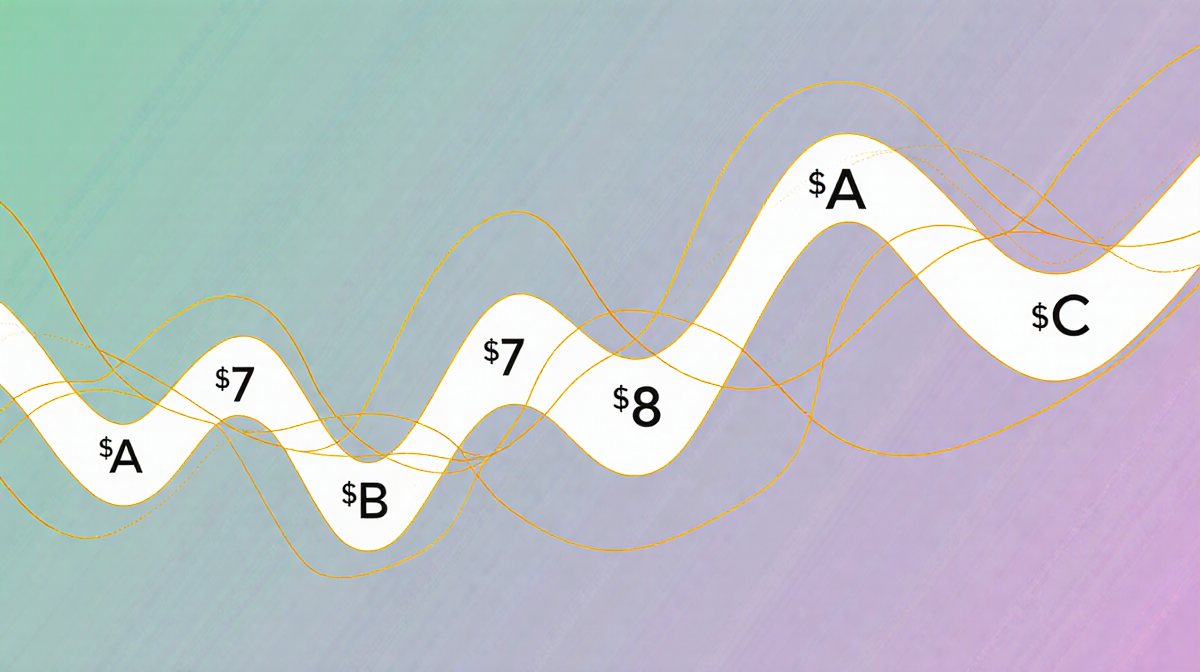

Chart Analysis

The chart presents a potential corrective wave structure marked as (A)-(B)-(C). XRP’s recent action fits within this framework. If the downward pattern remains valid, price levels near $1.85, $1.77, $1.73, and $1.66 are being tracked as possible support.

Traders are also focused on $1.80, a level tested multiple times over the past year. Whale Factor pointed to the current range between $1.80 and $2.10 as a possible setup for increased volatility, depending on which side breaks first.

Momentum Indicators

A falling wedge pattern was recently broken to the upside, leading to a short-term recovery. This pattern often points to exhaustion in a downtrend. Volume rose slightly during the breakout, but has not yet confirmed strong buyer control.

Momentum signals are showing signs of change. On the MACD histogram, red bars have decreased, suggesting fading selling pressure. Analyst CW shared that a sub-indicator is pointing to a trend shift, with a convergence break suggesting early bullish momentum.

Whale Activity

XRP saw large movements in January, with 130 million tokens transferred to exchanges, according to Steph Is Crypto. Binance’s XRP balance rose to 2.74 billion, reaching its highest level since November. Some traders see this as increased liquidity returning to the market.

Data from Coinglass shows a 17 % drop in trading volume, while open interest rose by nearly 3 % to $3.38 billion, indicating that new positions are being built. These shifts reflect growing anticipation around XRP’s next direction.

Market Sentiment

The current range between $1.80 and $2.10 is seen by some analysts as a potential catalyst for volatility. If XRP breaks above $1.97, it could unlock new upside; if it fails, a decline toward the next support levels could follow.

The volume-to-open-interest dynamics suggest that traders are positioning for a breakout. The slight rise in volume during the wedge breakout, combined with a decline in selling pressure on the MACD, points to a possible shift in sentiment.

Key Takeaways

- XRP is testing the $1.97 resistance after a pullback from $2.40.

- A breakout could change the short-term structure; a rejection supports a bearish view.

- Whale movements and rising Binance balance indicate liquidity returning.

- Momentum indicators show early signs of a trend shift.

- Market participants are watching the $1.80-$2.10 range for a potential volatility catalyst.