> At a Glance

> – XRP debuts on Hyperliquid’s orderbook as FXRP/USDC spot pair

> – One-click bridge returns FXRP to XRP Ledger for lending and staking

> – First XRP spot market on Hyperliquid powered by Flare Smart Accounts

> – Why it matters: Traders gain institutional-grade XRP exposure without ever giving up custody

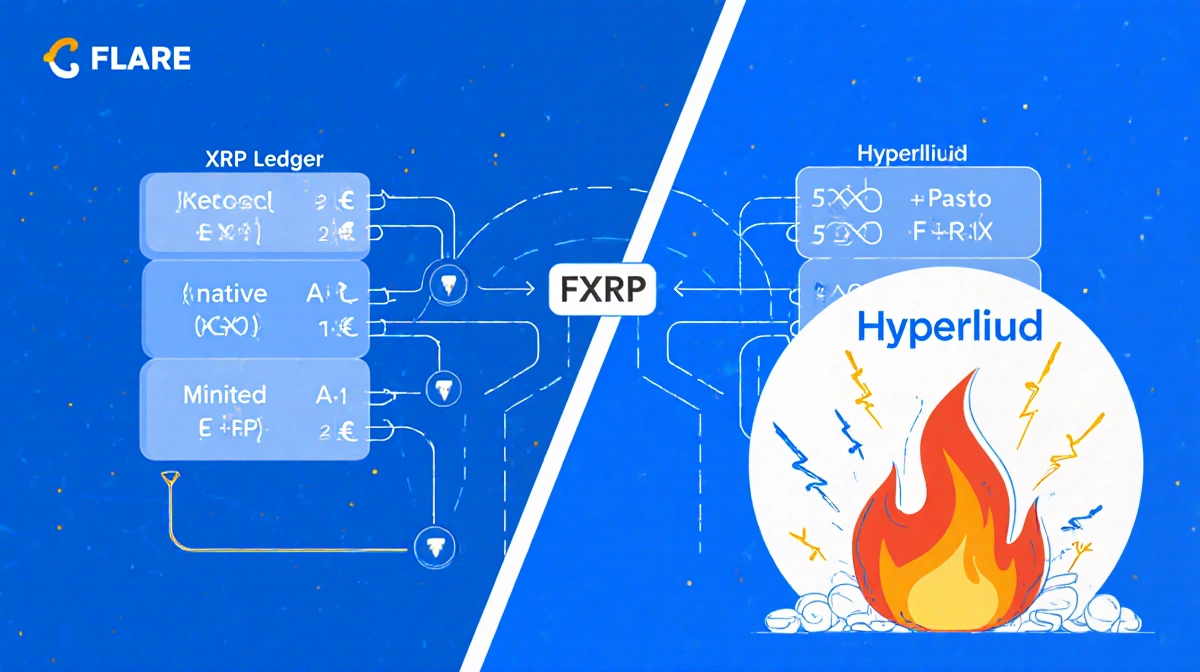

XRP holders can now tap Hyperliquid’s high-speed orderbook thanks to Flare’s new cross-chain setup that turns XRP into tradeable FXRP and back again.

How the FXRP Bridge Works

Flare’s FAssets system and LayerZero’s Omnichain Fungible token standard lock XRP on the XRP Ledger and mint FXRP on Hyperliquid. When trading ends, users click once to withdraw; Flare Smart Accounts burn FXRP and release native XRP to the original address.

- Trade FXRP against USDC on Hyperliquid

- Bridge back to Flare for DeFi apps-lend, stake, or supply liquidity

- No custody hand-off at any stage

Hyperliquid Edge vs AMMs

Hyperliquid’s central-limit orderbook aims to beat automated market makers on price discovery and execution depth, especially when volume spikes.

| Feature | AMM Pools | Hyperliquid Orderbook |

|---|---|---|

| Price Discovery | Algorithmic | Central-limit bids/asks |

| Execution | Slippage-prone | Deep liquidity |

| Throughput | Network congestion | Optimized for bursts |

What the Teams Say

Dhruv Shah, Flare DeFi analyst:

> “FXRP brings a new asset class into Hyperliquid’s ecosystem while remaining fully on-chain end-to-end.”

Hugo Philion, Flare co-founder:

> “This listing brings XRP into one of the most liquid and performant on-chain trading environments available today.”

Key Takeaways

- XRP liquidity expands to Hyperliquid’s institutional-grade venue

- Users keep self-custody throughout the FXRP lifecycle

- Strategy options now include directional trades, hedges, and cross-venue arbitrage

- XRPL remains the canonical settlement layer while FXRP explores DeFi

The integration turns XRP into a multichain, programmable asset without weakening its home ledger’s authority.